General Liability insurance

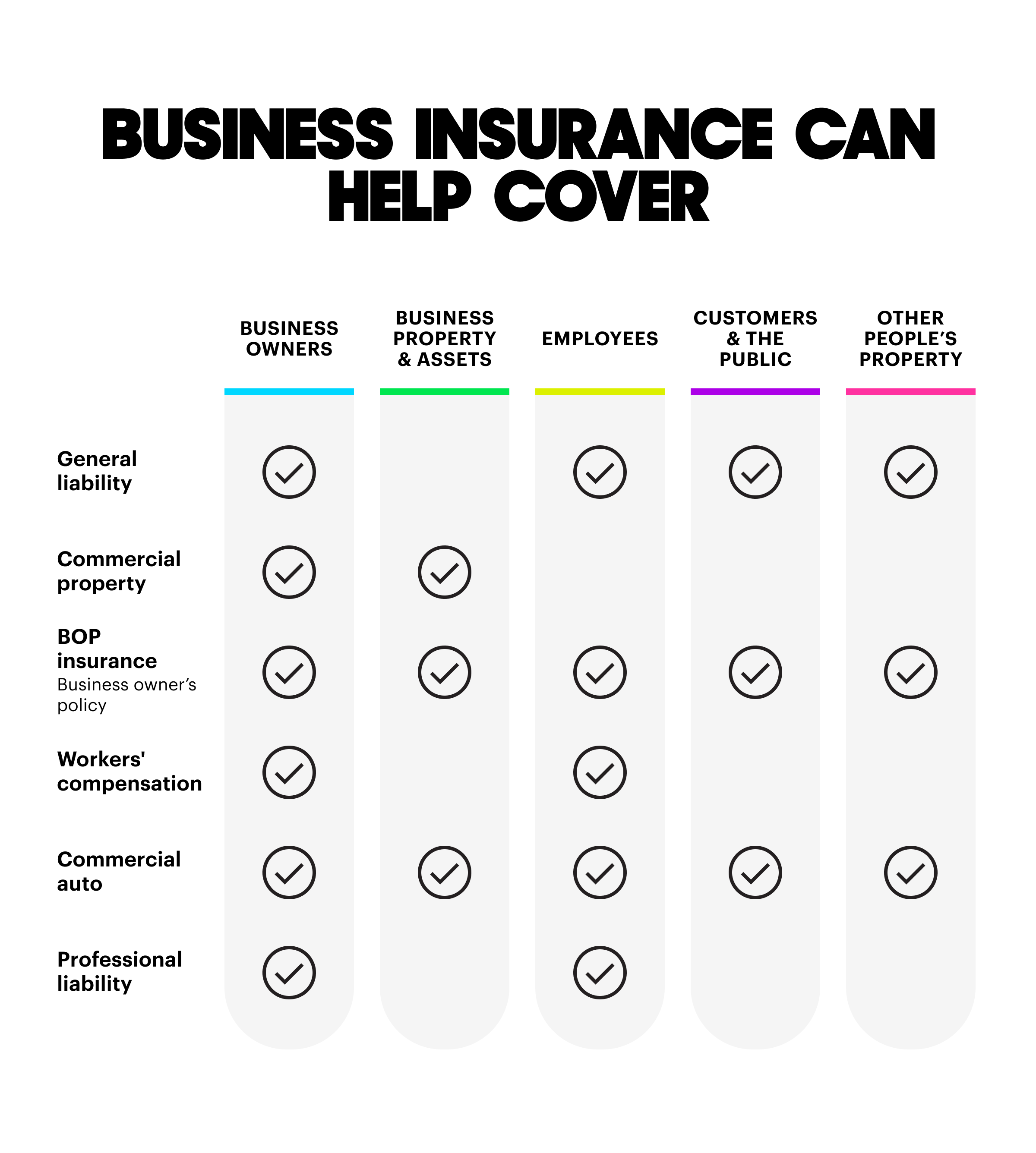

General liability insurance, also known as business liability insurance, is often the first insurance business owners buy. It can help your business cover costs if you or an employee accidentally damage someone’s property or if someone other than an employee gets hurt (the legal term for this is bodily injury).

Learn more about general liability insurance.

Commercial Property insurance

Commercial property insurance can help protect many of the physical items you need to do business. It can help pay replacement costs if your business property suffers damages by water, fire, wind or vandalism. It can also help cover business income after a covered event.

Learn more about commercial property insurance.

BOP insurance (Business Owner’s Policy)

A business owner’s policy (BOP insurance) combines general liability insurance and commercial property. It is often cheaper to bundle these two policies. Together they can provide broader protection for your business.

Learn more about BOP insurance.

Workers’ Compensation insurance

Workers’ comp insurance covers workplace injuries. If an employee gets hurt on the job or gets a work-related illness, it can help pay for medical expenses and cover lost wages.

It’s often required by state law when you have employees. You can also protect yourself by opting for voluntary business owner’s coverage.

Learn more about workers’ compensation insurance.

Professional Liability insurance

Professional liability insurance can help protect your business from professional mistakes. This kind of coverage is also known as errors and omissions (E&O) insurance. It is common for professional services such as real estate agents, accountants, IT professionals and more.

Learn more about professional liability insurance.

Commercial Auto insurance

Commercial auto insurance is for small business owners who own or drive vehicles for work. It can help pay for damages if you or an employee are involved in an auto accident while driving for business.

Learn more about commercial auto insurance.

Some types of business insurance are designed for specific industries

Some business insurance policies offer more niche coverage options designed specifically for specific types of businesses.

For example:

- Retailers: Product liability insurance can help protect your business from legal fees if a customer says an issue with your product caused an injury or property damage. It is included with NEXT general liability coverage for retailers.

- Restaurants and food service: Liquor liability insurance can help provide financial help for restaurants if you serve alcohol to someone who causes an injury or property damage.

- Construction and cleaning: Tools & equipment insurance at NEXT can help construction and cleaning businesses repair or replace tools and equipment if they are stolen or damaged outside of normal wear and tear.

How much does small business insurance cost?

Business insurance costs can vary tremendously. That’s because every business has different coverage needs, potential risks and unique circumstances.

For example, insurance for a restaurant will be priced differently than for a handyman or financial advisor.

While it can be difficult to give a precise business insurance cost estimate — for that, you’ll need to get a quote for your business — here are some of the factors that help determine what your insurance will cost.

- Your payroll and the number of employees

- Where you work and your number of business locations

- Your industry

- Your experience

Learn more about the cost of business insurance.

Get a quick estimate to see how much insurance could cost your business with NEXT’s insurance calculators:

How to get business insurance

Getting insurance for your business is simple and fast with NEXT. You can get the coverage you need in three ways:

1. Buy online

You can buy business insurance 100% online with NEXT in about 10 minutes. When you click “Get Instant Quote,” we’ll ask you some basic questions about your business and operations.

We’ll guide you every step of the way. After answering these questions, you’ll have a customized insurance quote for recommended coverage. If you like what you see, you can adjust the package limits and make your purchase.

Your coverage will begin after payment and you’ll have access to your certificate of insurance.

2. Purchase through an agent

Most people are familiar with this method of purchasing insurance. NEXT agents are available in every state and can help you understand coverages and local requirements.

To purchase insurance through an insurance agent, you typically need to provide information about your business and its specific needs.

The agent will assess your requirements and provide you with policy options. They’ll explain the coverage details, answer your questions and help you choose the most suitable policy. Once you make a decision, the agent will assist you in completing the necessary paperwork and complete the purchase.

3. Partner with other business services

NEXT lets business owners purchase insurance through the small business tools they’re already using.

Through partnerships with trusted providers like QuickBooks, LegalZoom, Gusto and more you can protect your business without ever leaving your account.

Regardless of how you purchase NEXT coverage, you’ll get easy access, knowledgeable experts who can answer your questions and unlimited access to certificates of insurance (COIs) without additional charges.

How NEXT helps small businesses get the right coverage

NEXT is 100% dedicated to small businesses and the self-employed. That means we can help you get the simple, affordable coverage you need to stay protected, meet legal requirements and provide customers with proof of insurance.

Whether you’re a contractor, restaurant, retail store, or just starting your side hustle, we’ll help you stay safe by providing coverage tailored to your profession.

Our customized commercial insurance packages can also be tailored to different business structures: