General Liability Insurance

Protection for common business accidents

Choose your primary industry to get started:

General Liability can help cover a wide range of risks to your small business

Slip-and-fall injuries

Someone trips at your business, breaks their leg and files a lawsuit. Excluding employees.**

Property damage

You accidentally damage a client or customer’s property.

Legal fees & defense costs

You need an attorney to defend your business in a lawsuit after a claim.

Medical payments

Someone (excluding employees) gets injured and asks you to pay for medical expenses.

Reputational harm

An employee bad-mouths a client online and the client sues you.

Advertising injury

You’re sued for improper image use in your advertising.

What is General Liability insurance?

General liability business insurance can provide financial protection for some of the most common accidents at a business:

- Damage to property that you don’t own

- Injuries to people who are not employees

It’s one of the most common types of insurance because it’s often required by licensing agencies or clients before they’ll work with you.

Commercial general liability can also provide some protections related to reputational harm and advertising.

It’s sometimes called “business liability insurance, “public liability” or simply “liability insurance.”

Protect your business today.

What can General Liability cover?

General liability insurance coverage can help protect your business from unexpected expenses related to accidents and lawsuits that can affect your business, such as:

- Injuries to people who are not your employees.

- Damage to another person’s property.

- Court and legal fees.

- Medical payments.

- Harm caused by your advertisements.

- Accusations of libel or slander (personal injury or reputational harm).

Who needs General Liability insurance coverage?

Restaurants and food service

Slip-and-fall accidents are a risk for restaurant businesses. A general liability policy could help cover medical payments and lawsuit expenses for these types of accidents. Some businesses may also add liquor liability or workers’ compensation for more coverage.

Construction trades

General contractors and other construction professionals are often required to have general liability insurance to get professional licenses or work on certain jobs.

Retail and E-Commerce

Brick-and-mortar business owners can benefit from the protection GL provides for customer injuries. NEXT policies also include some protection for product liability.

Sports and fitness professionals

If you’re a personal trainer, fitness instructor or yoga teacher, you might need fitness insurance for some professional certifications. It can be required to work at a gym.

Janitorial and cleaning businesses

General liability business insurance can help protect cleaners from financial losses if they accidentally break or damage property at a job.

Why is General Liability important?

It can help you get more jobs

Having insurance shows clients that your business is trustworthy and that you have taken precautions against potential mistakes. That’s why some business owners advertise that they’re insured.

It could give you a competitive advantage if a potential client has a choice between your business and another business that doesn’t have insurance.

Many larger clients also require coverage before they’ll sign a contract with you.

It keeps your business in compliance

Some states and cities will only give you a business permit if you have an active general liability insurance policy and a certificate of insurance.

You might be required to keep your insurance active if your business is certified or accredited by a professional organization.

Your commercial lease might require it

Property owners may ask to see your certificate of insurance if you plan to rent commercial property. General liability is often required.

It lets you focus on growing your business

General liability insurance can give you peace of mind.

You can feel protected if a client trips and falls or you accidentally damage a customer’s expensive property

How much does General Liability cost?

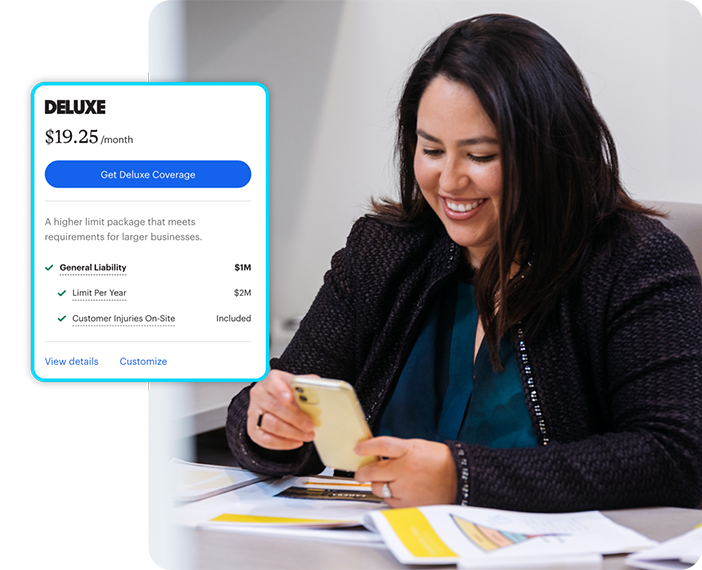

General liability insurance costs can be as little as $19 monthly for some low-risk businesses.†

Several factors influence the price you’ll pay for insurance, including:

- Your industry.

- Your business operations.

- The size of your business.

- Where you do business.

- Your business needs and how much coverage you choose.

- Policy limits.

Price calculator

Get an estimate of your business insurance cost

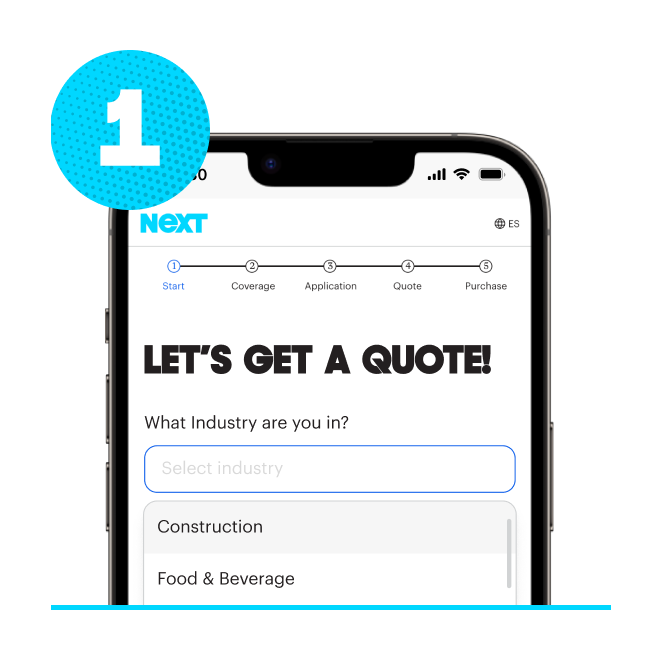

How do I get General Liability insurance?

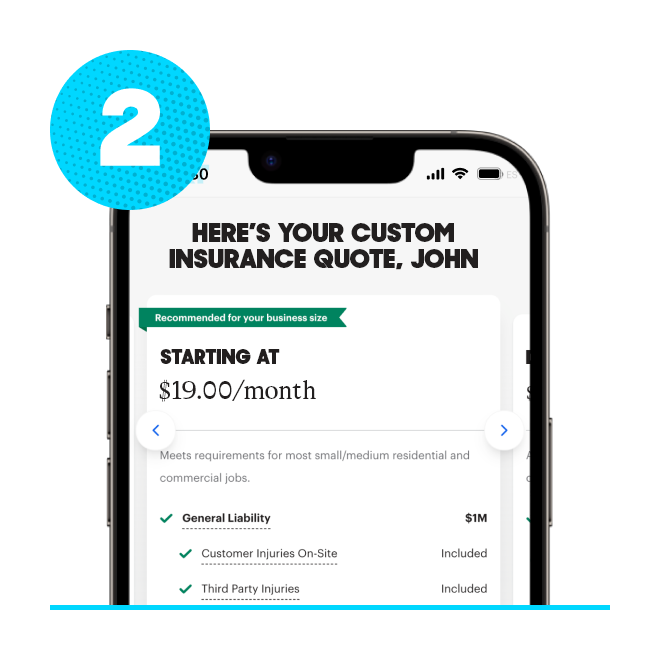

We’ll ask you some basic questions about your business and operations. You’ll get a customized insurance quote for general liability and other recommended coverage.

If you like what you see, you can adjust the package limits and make your purchase.

Your coverage begins right after payment and you’ll have access to your certificate of insurance at no extra cost.

Compare General Liability insurance

We’ll walk you through the differences and similarities between GL and other types of business insurance policies to help you make the best choice for your business.

General Liability insurance FAQ

If you don’t find the answers you’re looking for, our licensed insurance advisors are standing by to help.

Is General Liability insurance required by law?

General liability insurance is often the first type of coverage purchased by new business owners, but it’s not typically required by law.

However, some agencies might require coverage before issuing a professional license or permit. This is common in construction.

Clients might also ask for proof of insurance before they will work with you.

Does General Liability insurance cover property damage?

General liability insurance can cover expenses related to property damage, but only to property that does not belong to you.

Commercial property insurance can help protect the physical items you need to operate your business, such as:

-

Inventory

-

Business equipment

-

Furniture and furnishings

-

Physical structures

BOP insurance (Business Owner’s Policy) combines general liability insurance and commercial property insurance into one package that is usually less expensive than buying both coverages separately.

Does commercial General Liability insurance cover theft?

General liability insurance doesn’t cover the theft of your own possessions, but it might cover the theft of customer property.

If any of your personal or business items are stolen, you won’t be covered without additional insurance to protect your own gear, such as tools and equipment insurance.

You can bundle tools and equipment coverage with your NEXT general liability coverage if you’re a contractor or own a cleaning business.

Does General Liability insurance cover employee injuries?

General liability insurance can help pay for expenses if your business is accused of causing an injury, but injuries to you or your employee are not included.

Workers’ compensation insurance can help pay for medical expenses and lost wages if an employee is hurt on the job.

Most states legally require you to buy workers’ comp coverage as soon as you hire an employee. Optional business owner’s coverage is an add-on that can help provide benefits for business owners if they get hurt on the job.

Is General Liability insurance tax deductible?

General liability insurance premiums can typically be deducted from your taxes. Consult with a licensed accounting professional to make sure you qualify.

The IRS categorizes payments you make for this type of insurance to be both an “ordinary and necessary” business expense. Keep a record of how much you pay every year for your policy.

How much General Liability insurance do I need?

Our small business insurance isn’t one-size-fits-all. Each business is unique and has different insurance needs.

The coverage you need depends on a number of factors, including:

-

The type of work you do.

-

How many employees and subcontractors you have.

-

Your level of risk.

-

The state where you work.

When you get a free online quote with NEXT, you can review options and adjust limits to your preference.

When will I get my policy documents and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

How do I make a General Liability insurance claim?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

Get customized insurance wherever you do business

Learn more about general liability insurance options in the state where you work.

NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought next was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.