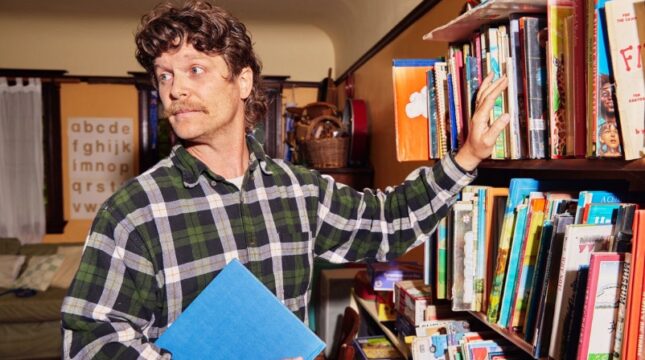

Customized teaching and child care business insurance

Whether you’re hosting an online class or keeping a watchful eye on infants at your daycare, NEXT Insurance is a one-stop shop for education business insurance. We deliver easy, affordable insurance so you don’t need a cheatsheet to figure out the coverage that is best for you.

And for bonus marks, you can save up to 10% when you bundle two or more policies.