Customized business insurance in Nebraska

Small business growth in Nebraska is outpacing the national rate, and these companies employ more than 412,000 of the state’s workers.1

Building a successful small business takes plenty of hard work and resourcefulness, and purchasing the right insurance plays a major role in keeping your company in good financial health. Business insurance in Nebraska helps pay for incidents such as:

- Claims of injury or property damage

- Accusations of professional negligence that cause financial damages

- Employee injuries that happen at work

- Damages from business-related automobile accidents

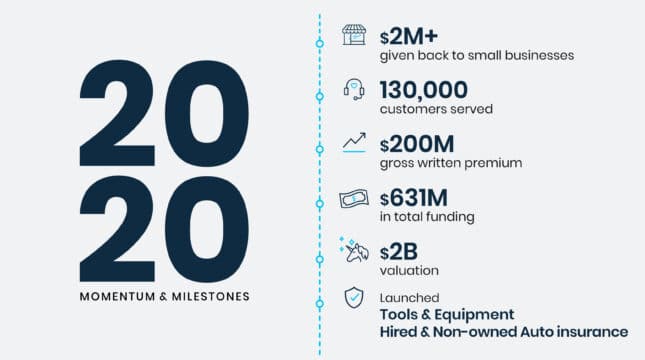

NEXT Insurance helps more than 1,300 types of small businesses and self-employed workers quickly get the coverage they need online at the best price. We specialize in small business insurance, so we can easily help you find a custom insurance package that is right for you.

Continue reading to find out about the most important types of business insurance in Nebraska or start a free instant quote to review options for your business.