What is business insurance?

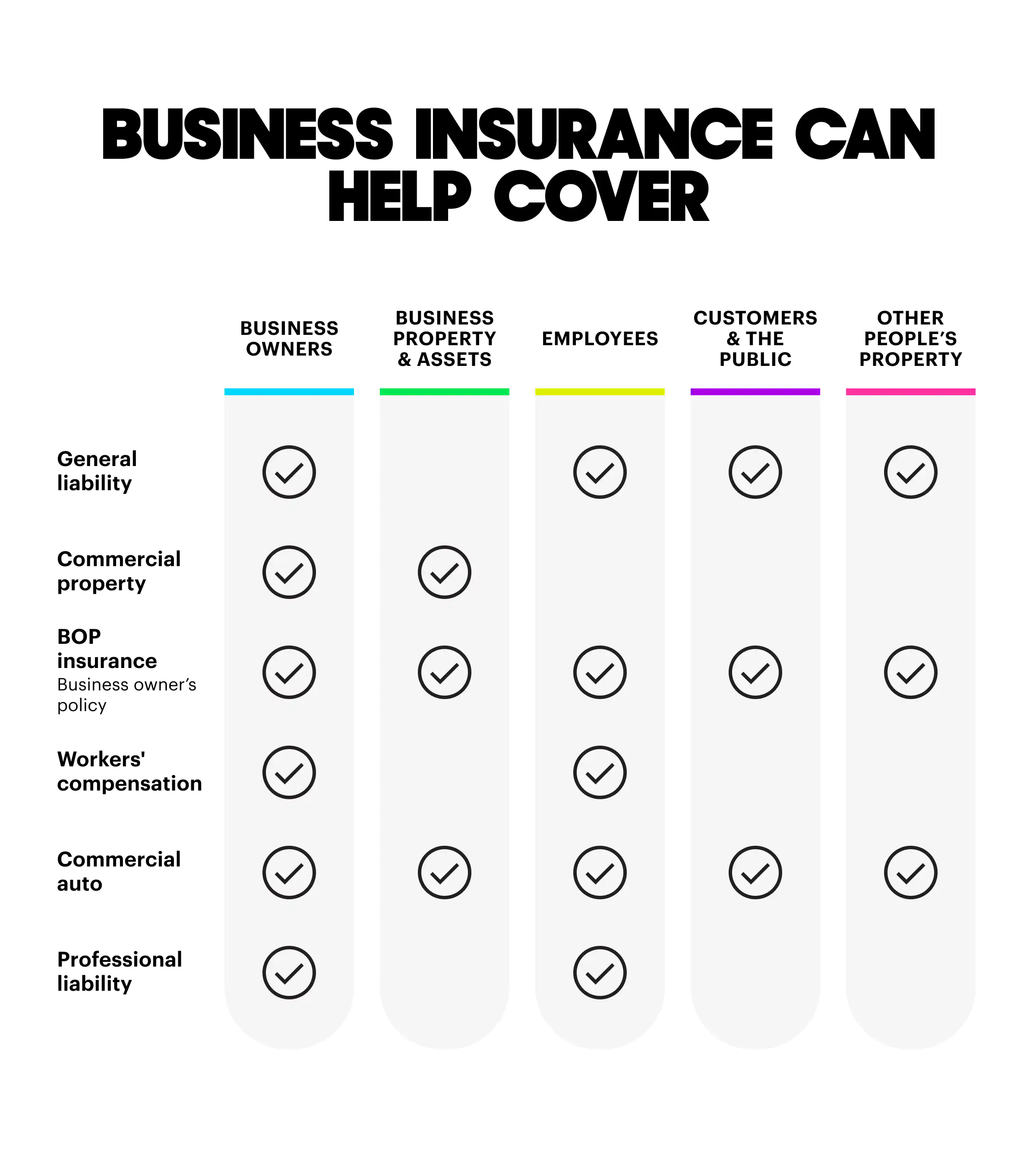

What can small business insurance cover?

- Injuries to customers and employees

- Property damage

- Legal expenses after a covered accident

- Lawsuits and related fees

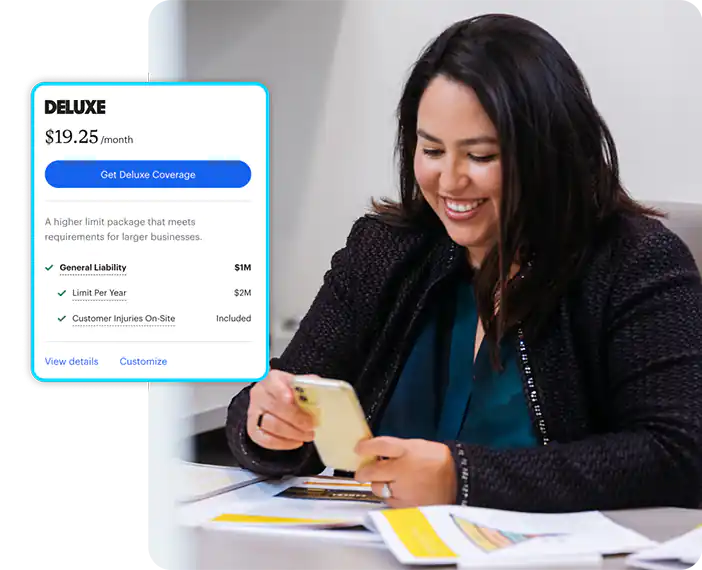

How much does business insurance cost?

Starting at $19/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs business insurance most?

- Almost every small business owner can benefit from having business insurance

- Self-employed workers

- Sole proprietors

- Limited liability companies (LLCs)

The best business insurance companies can help protect your business

Cover unexpected costs

Provide financial help after some business accidents or mistakes.

Quickly resolve your claims

Offer protection for your business, property, liability and employees.

Set you up for success

Fulfill proof of insurance requirements from clients, partners and regulators.

How much does business insurance cost?

Business insurance online can cost as little as $19/month† for some low-risk businesses.

Several factors influence your business insurance quote, including:

- Your industry

- Your business operations

- The size of your business

- Where you do business

- Your business needs and how much coverage you choose

- Policy limits

How to get small business insurance online

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for business insurance online.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately or next day. And your certificate of insurance can be shared at no extra cost.

Who needs commercial business insurance?

Restaurants and food service

Restaurant businesses could get help with financial losses after a fire, vandalism, HVAC breakdown, weather damage or a customer slip-and-fall. Liquor liability and workers’ comp may be required by state law.

Retail and e-commerce

Stores, shops and online business owners can benefit from protection over inventory, products, building damage and customer injuries. ERGO NEXT also offers some protection for product liability if you make products you sell.

Offices and professionals

Whether you’re a home office worker or you lead a team downtown, if you sell advice or knowledge, such as an insurance agent, consultant, tech worker, accountant or engineer, small business business insurance for professional mistakes could help protect you.

Construction trades and contractors

Contractors and other construction professionals are often required to have a business insurance policy for professional licenses or to bid on some jobs.

Cleaning and janitorial services

Commercial cleaners and house cleaners can get protection from financial losses if they get hurt or accidentally break or damage someone’s property on the job.

Business insurance FAQ (frequently asked questions)

How do I make a business insurance claim?

You can file a claim anytime online or in the ERGO NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the ERGO NEXT app for iPhone or Android.

How much business insurance do I need?

The amount of business insurance best for your business depends on many variables, such as:

- Your level of risk

- The state where you work

- The type of work you do

- How many employees, subcontractors and customers you have

- The value of your business property

- Your building structure and stability

ERGO NEXT’s online quote tool will prompt you for answers to give you an exact quote for business insurance specific to your business.

Get customized insurance wherever you do business

Learn more about insurance options in the state where you work.

ERGO NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought next was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

Easy to process

Where other websites did not deliver on a timely manner, this was relatively easy to get a quote and finish the process in a few minutes after accepting it. It was also easy to mod...

Riccardo H.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.