Solar Contractor Insurance

You can save up to 25% in discounts on business insurance.*

Choose your primary coverage to get started:

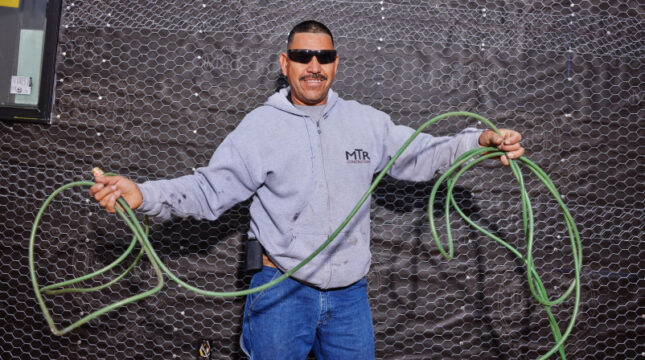

Solar contractor insurance that's made for your business

NEXT specializes in providing customized insurance for small businesses and the self-employed. We offer affordable coverage tailored to solar contractors so you are always protected against unpredictable events. The most common insurances packages bought by solar contractors include:

- General liability

- Contractors’ E&O

- Tools & equipment

- Commercial property

General Liability

general liability can help you pay for:

Contractors' E&O

professional liability can help you pay for:

Tools & Equipment

inland marine can help you pay for:

Commercial Property

commercial property can help you pay for:

You can save up to 25% in discounts on solar contractor insurance

You can pay for your insurance monthly or annually and you can cancel instantly at any time.

How much should a solar contractor expect to pay for business insurance?

Your solar contractor insurance costs will be tailored to your business. Several factors will impact the price you pay, including:

- Your claims history

- How high you set your limits

- Your work experience

- How many people you employ

With coverage built for more than 1,300 small business professions, NEXT offers you the right small business insurance at the right price, no matter what you do.

Learn more about solar contractor insurance costs and coverage.

How important is it for a solar contractor to have business insurance?

We know building a small business is an investment. To protect that investment, solar contractors need insurance to avoid financial losses. Business insurance can protect your from:

- Lawsuits. Without insurance, you might have to pay entirely out of pocket after an accident or mistake.

- Damage to the physical items you need to do business.

- Claims of work mistakes or negligence.

- Injuries if an employee gets hurt on the job. Insurance can pay for medical expenses and help cover lost wages.

NEXT is dedicated to helping solar contractor business owners find the affordable coverage you need to stay protected, meet legal requirements and satisfy your customers.

Frequently asked questions about solar contractor business insurance

Here are some of the most common questions we get about solar contractor business insurance. If you don’t find the answers you need here, our licensed, U.S.-based insurance advisors are standing by to help via online chat or phone.