What are Workers’ Compensation laws?

Workers’ compensation insurance can help provide employees with medical benefits and wage replacement if they’re injured or contract an illness on the job. Business owners buy a policy to cover their employees.

Self-employed workers (“solopreneurs”) can also get workers’ comp insurance to help protect themselves.

Workers’ compensation insurance laws exist for two reasons: To protect employees and business owners.

Workers’ Compensation laws to protect employees

The potential for insurance coverage to help cover medical expenses and wages can be a huge benefit for employees. If a worker gets injured or sick on the job, it can be essential for keeping a working family afloat.

Workers’ comp laws can also save workers time and energy. Instead of suing an employer and enduring the effort and costs of a legal case, workers can be reimbursed by an insurance policy. And if their illness or injury meets the criteria for coverage, workers’ compensation insurance can eliminate the risk of loss in a court case — in which they may receive nothing.

Workers’ Compensation laws to protect employers

Insurance premiums are a small price to pay when you consider the alternative cost potential for business owners — lawsuits and out-of-pocket expenses.

If a worker breaks their leg on the job and you don’t have workers’ comp coverage, out-of-pocket costs for covered events like ambulance, hospital fees and rehab could put your business at financial risk.

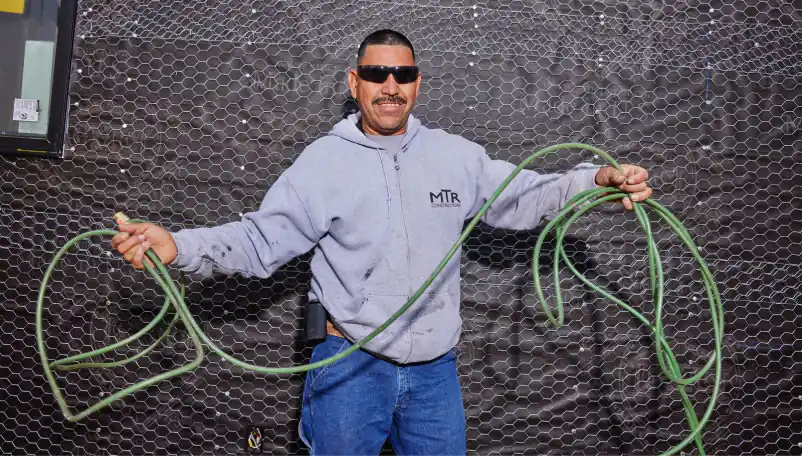

Carrying workers’ comp also helps you position yourself as a professional in your field. For example, if you’re in construction, workers’ compensation for contractors is often a requirement for getting licensed and bidding on contracts. If you don’t have it, your company won’t even be considered for the job.

Workers’ compensation laws (formerly known as workmans comp laws) are created by and unique to each U.S. state. And every state dictates coverage requirements that employers need to provide for their employees.

Each state’s unique laws spell out:

- When/if workers’ compensation insurance is required.

- Who is eligible to make a claim.

- How an insurance claim must be filed, for what reason and when.

Workers’ Compensation rules by state

The laws and rules around workers’ compensation insurance coverage and claims vary depending on where you operate your business.

Purchasing workers’ comp is often mandatory, but employers must proactively go out and buy it on their own.

Learn more about workers’ compensation insurance coverage.

State Rules on Workers’ Compensation Insurance

| Is Workers’ Comp required? | Laws and rules |

| Alabama Workers’ Comp | Yes | Required for any business of 5+ employees, and anyone in construction of single-family homes |

| Alaska Workers’ Comp | Yes | Part-time, temporary, family members and friends who are employees must be included in coverage |

| Arizona Workers’ Comp | Yes | Workers’ comp can cover up to $5,000 in burial expenses, and survival benefits can be up to 66% of the employee’s average monthly wage |

| Arkansas Workers’ Comp | Yes | Employers must display a poster with claim filing instructions in the workplace |

| Colorado Workers’ Comp | Yes | Coverage is required for any business with 1+ employees |

| Connecticut Workers’ Comp | Yes | Any business that fails to obtain workers’ comp is subject to penalty fees of $100 per day |

| Florida Workers’ Comp | Yes | Some business owners, officers and members of an LLC business are eligible for a workers’ comp exemption |

| Georgia Workers’ Comp | Yes | Workers’ comp is mandatory for some professional licenses and contracts like a general contractor license |

| Hawaii Workers’ Comp | Yes | Insurance for employees is required, but some business owners are exempt from insuring themselves |

| Idaho Workers’ Comp | Yes | Workers’ comp is required before the first employee is hired, and the mandate extends to workers working from home |

| Illinois Workers’ Comp | Yes | Any business owner who works in construction is required to carry coverage |

| Iowa Workers’ Comp | Yes | Employers are required to file a First Report of Injury within four days of notice or knowledge of a work injury |

| Kansas Workers’ Comp | Yes | Non-agricultural businesses with a gross annual payroll of more than $20,000 must have workers’ comp |

| Kentucky Workers’ Comp | Yes | Employers who fail to obtain required workers’ comp coverage are subject to a fine of $100 to $1,000 per employee |

| Louisiana Workers’ Comp | Yes | Seasonal workers and minors count as employees as much as full-time and part-time workers |

| Maine Workers’ Comp | Yes | Some employers from other states with employees working in Maine temporarily are not required to carry workers’ comp |

| Maryland Workers’ Comp | Yes | A worker must be hurt “on the job”, and not just at work, for insurance to help cover some costs |

| Mississippi Workers’ Comp | Yes | Employers with 5+ employees must carry workers’ comp |

| Missouri Workers’ Comp | Yes | Workers’ comp is optional for a business with 5 employees or fewer |

| Montana Workers’ Comp | Yes | Household and domestic employees are exempt from the workers’ comp requirement |

| Nevada Workers’ Comp | Yes | Workers’ compensation benefit payments are set by the state government |

| New Hampshire Workers’ Comp | Yes | Employers must have a workers’ comp policy in good standing before any employees can be hired |

| New Mexico Workers’ Comp | Yes | Part-time, seasonal and temporary workers, agricultural employers and nonprofit, charitable and religious organizations all count as employees |

| Oklahoma Workers’ Comp | Yes | Sole proprietors are not considered employees and they’re not required to have coverage |

| Oregon Workers’ Comp | Yes | The first offense for a business that does not follow the workers’ comp mandate can be twice the estimated premium |

| South Carolina Workers’ Comp | Yes | Certain real estate agents who work on commission are exempt from workers’ comp |

| South Dakota Workers’ Comp | No | Though workers’ comp is not required, the state recommends it for businesses with employees |

| Tennessee Workers’ Comp | Yes | If a worker has a temporary disability from a work injury or illness, they are entitled to 110% of their wages |

| Texas Workers’ Comp | No | Going without workers’ comp means you could be held responsible for expenses if an employee gets hurt on the job |

| Utah Workers’ Comp | Yes | Independent contractors with no employees are exempt from the workers’ comp mandate |

| Virginia Workers’ Comp | Yes | If your business hires subcontractors, the workers’ comp requirement still applies — even if the subcontractor has their own coverage |

Who can make a Workers’ Comp claim?

To file a workers’ comp claim, the claimant must be an employee. Their employer — you, the business owner — must have a workers’ comp policy in good standing. And the resulting illness or injury must occur while the employee was working on the job.

In addition, there are time restraints in terms of making a claim. A workers’ compensation claim must be made in accordance with the state’s deadline for reporting it.

Many on-the-job illnesses or injuries could be a valid reason for a workers’ comp claim. This could include cases when an employee:

- Breaks an arm falling from a ladder

- Gets sick from chemicals used at work

- Experiences hearing loss from a loud work environment

- Gets carpal tunnel syndrome from repetitive work-related tasks

A successful workers’ compensation claim could include reimbursement for:

- Medical expenses

- Loss of income

- Job retraining

- Permanent injury

- Survivor benefits

Learn how to file a workers’ compensation claim at NEXT.

A workers’ comp claim could be disputed or denied for several reasons, including:

- If the employee was performing a task in violation of the policy. This is particularly relevant in more dangerous jobs where covered and non-covered activities are explicitly detailed.

- If the employee was drunk or under the influence of drugs.

- If the injury or illness is not related to work.

How NEXT helps protect employers and employees

NEXT is 100% dedicated to helping small business owners find the right business insurance.

With our streamlined application, you can get a quote, see coverage options and purchase coverage in about 10 minutes. You can access your certificate of insurance and your policy online any time, 24/7.

If you have questions, our licensed, U.S.-based insurance professionals are available to help.

Start a free online quote with NEXT today.

The information provided on this article does not, and is not intended to, constitute legal advice. All information available on this page is for general informational purposes only, and you should consult an attorney with specific questions about your own business.