Management consulting insurance can help protect you from

Business errors

A client or customer accuses you of making a professional mistake that costs them money.**

Claims of professional negligence

Someone claims your inaction or wrongdoing caused financial loss or personal harm.

Legal fees and defense costs

You need an attorney to defend your business in a lawsuit after a claim.

Get management consultant insurance that’s fast, easy and affordable

NEXT specializes in small business insurance. Business insurance for your management consulting business can help protect you, your company and your employees from the cost of unexpected events.

NEXT makes it easy to:

- Check prices, get covered and buy 100% online in about 10 minutes.

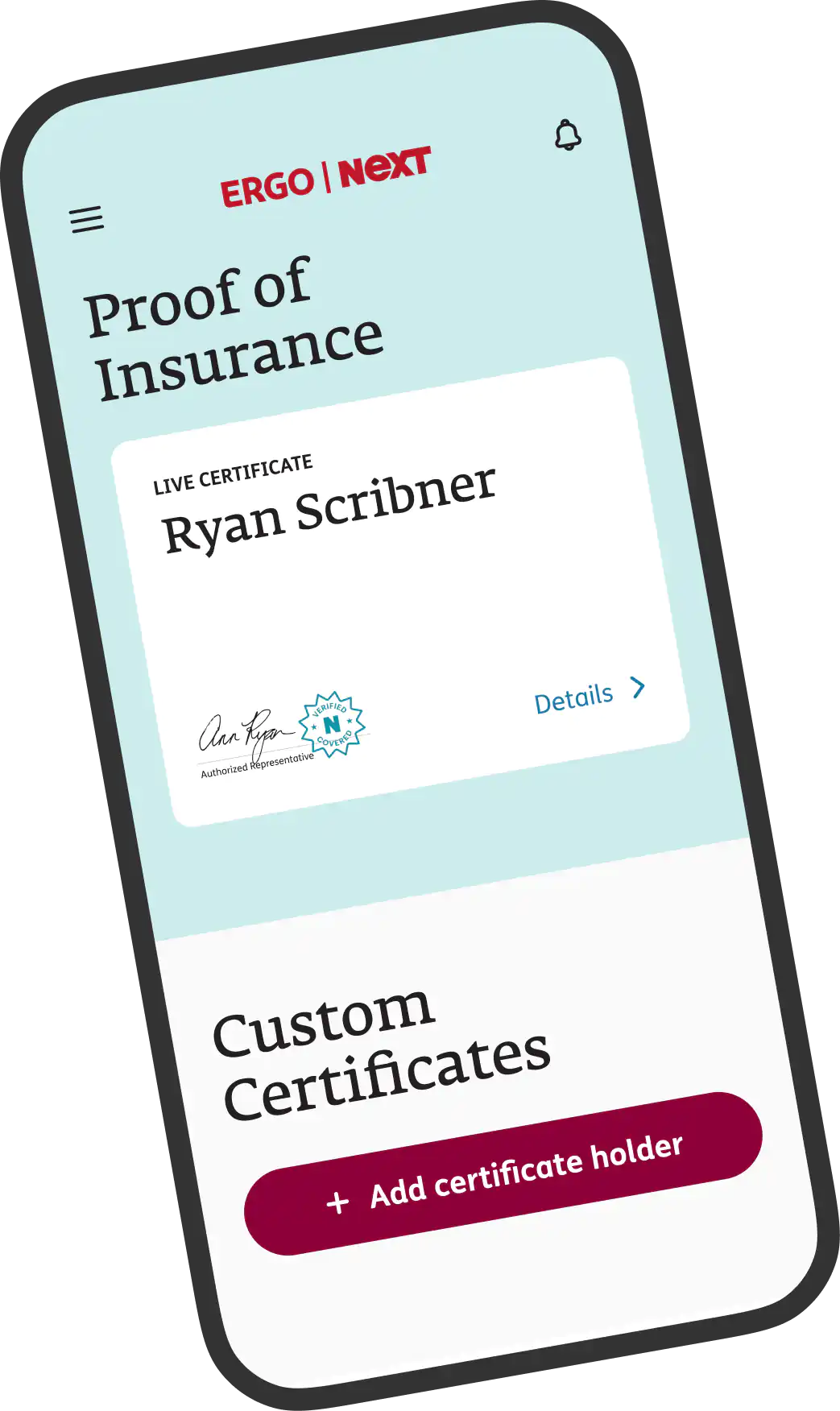

- Manage your policy 24/7 via web or mobile app.

- Pay monthly or annually and cancel anytime.

- Get unlimited certificates of insurance (COI) to share proof of insurance at no extra cost.

General Liability insurance

general liability can help you pay for:

Professional Liability insurance (E&O)

professional liability can help you pay for:

Workers’ Compensation insurance

workers compensation can help you pay for:

Commercial Property insurance

commercial property can help you pay for:

Cyber liability insurance

cyber liability can help you pay for:

NEXT Insurance reviews

business insurance

awesome speed and ease to get insurance in place

Brian O.

Seamless Setup

Excellent and responsive customer service and seamless set-up of WC Insurance. After trying to expand with my current provider and not having the follow up that I expected, I found...

Sherry A.

Business insurance

Affordable coverage quickly and efficiently, would definitely recommend ……

Melvyn W.

Easy

The process was clean and simple

Melanie M.

Excellent Service

Always a pleasure to do business with. Thank you for your efficiency and customer service. Thank you!

Ryan A.

Easy to sign up and competitive rates

I was looking for liability insurance as a subcontractor to a group that required such insurance. Next was quite easy to apply to online and seems to have a good customer satisfact...

Guy G.

Quick and easy = provisionally excellent

The process of securing a reasonable policy at a good price was excellent. Hopefully it will never be drawn on. That, of course, would be the real test of whether a policy is as go...

Mark S.

Great Fit

super easy. i filled out what i did and what i needed and "poof" i got my offers. very reasonable.

Charles K.

Thank goodness for NEXT

When I started my coaching and consulting business in Alaska, I wasn't sure where to start when in came to insurance coverage. NEXT made it ridiculously easy to sign up. A few taps...

Krysta V.

Great experience! Made it really

Great experience! Made it really easy to do business with Next! NextLevel Solutions, Inc appreciate the great customer experience!

Ronnie S.

Save up to 25% in discounts on management consultants insurance

Pay monthly or annually, and you can cancel at any time.

How much does management consultant insurance cost?

Premiums for management consultant insurance are more affordable than you may think. The exact price you’ll pay for your business insurance cost depends on a number of factors, including:

- The type of work you do.

- The types of clients you have.

- Your business location.

- Your number of employees.

- Annual revenue.

- The coverage limits and deductible you choose.

- Your insurance claims history.

The best way to know for sure what you’ll pay is to check our prices. In about 10 minutes you’ll see the exact cost of tailored coverage for your business.

How can insurance for management consultants help your business?

You might need management consultant insurance to help your business:

- Defend against claims of professional negligence. If a client sues you for a professional mistake that leads to revenue loss, professional liability insurance could help cover legal costs.

- Protect your workspace and equipment. If you own, lease or rent an office, commercial property insurance could help cover building damage or theft of business property.

- Hire employees. Most states require workers’ comp insurance for businesses with employees.

- Drive for business. Business-owned vehicles and personal vehicles you drive for work typically require commercial auto insurance.

Management Consultant insurance FAQ

If you don’t find answers to your frequently asked questions here, our licensed, U.S.-based insurance advisors are standing by to help.