Business liability insurance prices by profession

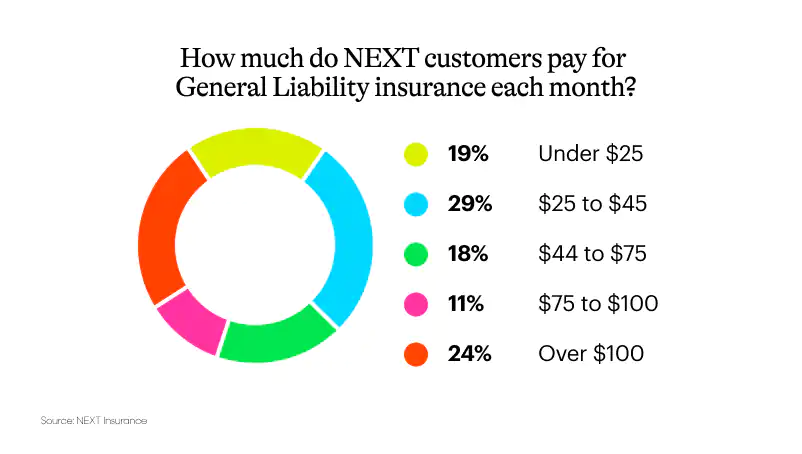

Insurance premiums vary based on the risks involved in the type of job that you do, among other factors. Check NEXT’s lowest monthly insurance premiums for general liability insurance in your line of work.

NEXT’s MONTHLY LOWEST GENERAL LIABILITY PREMIUMS†

6+ things that influence the cost of General Liability insurance

Your general liability insurance policy could help cover expenses if you experience a claim involving an injury to someone who is not an employee (known as bodily injury) or damage to property you don’t own. Several factors influence the cost of your insurance, including:

1. The type of work that you do

Higher-risk businesses could be more likely to have a claim involving injury and property damage. Jobs on other people’s property often have higher insurance premiums due to their higher risk.

2. Your number of employees

If you employ several people your liability insurance could cost more than if you work alone.

3. Your claims history

Your record of losses and claims with previous insurance policies could impact your small business insurance prices.

4. Your work experience

If you have 25 years of experience you may expect to pay less than someone new to their business.

5. How high you set your limits

Higher coverage limits offer more financial protection — but they almost always increase the monthly insurance premium.

6. The state where you work

Different states have different regulations and costs. Insurance rates are sometimes higher in densely populated areas that see more claims.

Note: It’s important to provide the most accurate information about your business when you get a general liability insurance quote. This can help to ensure you get the right coverage and avoid delays if you need to process a claim.

How to get a General Liability insurance quote

You can get the protection of general liability insurance for your business in about 10 minutes, 100% online with NEXT.

Answer a few questions and choose your coverage. You’ll have instant access to your proof of insurance (also called a certificate of insurance, or COI) immediately and at no extra cost. And you can manage your policy 24/7 via web or mobile app.

If you have questions, our licensed, U.S.-based insurance advisors are ready to help.