Read on to learn more about:

What does general liability insurance cover?

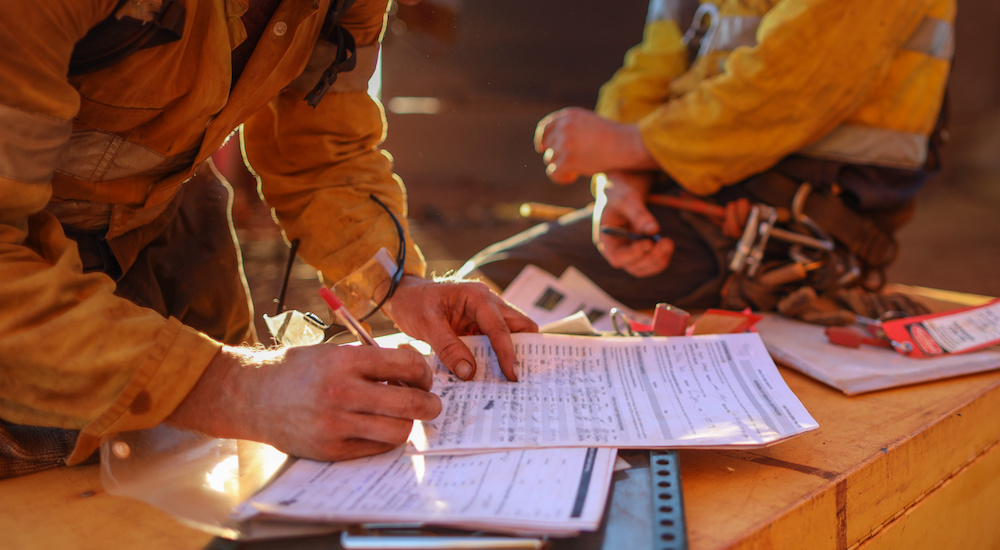

General liability is often the first insurance policy business owners purchase because it can cover some of the most common accidents that occur while doing business.

Some examples of claims general liability can help with are:

- Property damage to property you don’t own

- Slip-and-fall injuries to non-employees

- Advertising injury

The biggest thing to remember is that your business doesn’t have to be responsible for these accidents to be accused. That’s why in addition to the above examples, general liability insurance can help with legal fees and defense costs to defend your business after a claim is made, regardless of fault.

When is general liability insurance required?

General liability insurance is usually not required by law. However, you might be required to carry it for different professional reasons.

You may need to have general liability insurance to:

- Get licensed or certified. This could be a business license or a trade license or a certification.

- Sign a contract with a client or partner.

- Sign a lease.

General liability insurance shows clients and potential partners that your business has some protection if there is an accident or mistake, which can help increase your bottom line.

So while rarely legally required, having general liability coverage is just good business.

What other types of business insurance are required for a business license?

In some cases you might also be required to have workers’ compensation insurance for a business license or professional license. This is more often the case with construction trade licenses.

License and insurance requirements and resources for different trades

Since many professional licenses require insurance, we’ve compiled a list of what regulatory agencies ask for in each state:

How NEXT helps entrepreneurs thrive

We have customized insurance plans for over 1,300 small business professions. Whether you need a license or not, we make it easy to get the coverage you need with our simple online process

You can get a quote, purchase coverage and secure your certificate of insurance in minutes. And if you need help, we have licensed insurance advisors standing by to answer your questions.

Start an instant quote online today.