What is EPLI insurance?

What can EPLI insurance cover?

- Claims of workplace discrimination

- Legal harassment allegations

- Wrongful termination lawsuits

- ADA or employee rights violations

How much does EPLI insurance cost?

$18/per employee per year†

Buy online in about 10 minutes, and cancel anytime.

Who needs Employment Practices Liability insurance coverage most?

- Any business that serves the public

- Businesses with employees

- Small businesses without HR support

- Industries with high employee turnover

An EPLI policy could help with legal costs if your business is accused of:

Discrimination

A former employee files a lawsuit alleging they were fired because of age, race, age, religion, sex or disability.**

Wrongful termination

A former employee alleges they were fired in retaliation for a whistleblower claim.

Harassment

An employee alleges derogatory verbal or physical behavior like jokes, slurs, comments or offensive pictures.

Privacy invasion

Confidential employee health information is leaked and an employee sues.

Failure to hire or promote

A well-qualified applicant sues after they weren’t hired claiming it was because of their disability.

ADA violation

A visually-impaired customer sues because your website does not accommodate screen reader software.

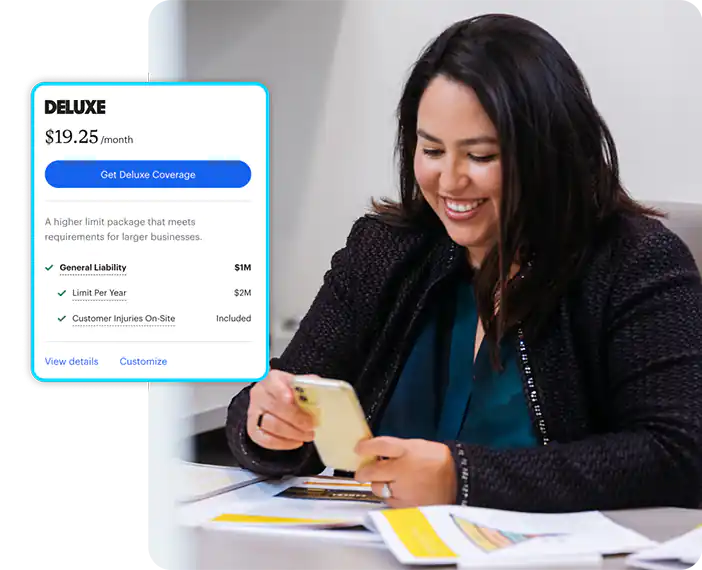

How much does EPLI insurance cost?

Employment Practices Liability coverage is available as an add-on to ERGO NEXT general liability insurance. General liability costs can start as low as $19 per month† for some low-risk businesses. And the EPLI add-on starts at just $18 per employee per year.

Several factors influence your business insurance quote, including:

- The type of work you do

- Number of employees

- Your claims history

- Your work experience

- The limits you choose

- The state where you work

How to buy a General Liability insurance policy with EPLI insurance online

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for EPLI insurance online.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective after payment. And your certificate of insurance can be shared at no extra cost.

Who needs EPLI business insurance?

Restaurants and food service

Restaurants, catering teams, bakeries and cafes can face high staff turnover and numerous customer interactions. EPLI could help protect against claims from customers or employees around harassment or discrimination.

Retail and e-commerce

Retailers and online sellers can employ seasonal teams. EPLI could protect you from claims for wrongful termination, unfair treatment or hiring disputes.

Offices and professionals

Professional services like accountants, business consultants and real estate agents can face claims tied to hiring, firing or discrimination. EPLI could help cover legal costs from employee or applicant lawsuits alleging unfair treatment or harassment.

Cleaners and janitorial businesses

Commercial cleaning companies, house cleaners and janitors often rely on small teams and frequent client contact. EPLI may help cover employment-related claims with staff.

Construction and contractors

Construction crews and contractors manage teams across job sites. EPLI can help cover claims tied to hiring, firing or employee treatment disputes.

Employment Practices Liability insurance (EPLI) FAQ (frequently asked questions)

What can EPLI insurance cover?

Employment Practices Liability insurance, an add-on to a general liability policy, could help cover legal fees, defense costs, settlements or judgments if your business faces discrimination lawsuits from employees or customers.

Common EPLI claims include harassment, wrongful termination and discrimination from employees, former employees, prospective job applicants, vendors or other business partners, and the public. Some examples include:

- Sexual harassment

- Breach of employment contract

- Negligent evaluation

- Age discrimination

- Failure to hire or promote

- Wrongful discipline

- Deprivation of career opportunity

- Wrongful infliction of emotional distress

- Mismanagement of benefits

- Wrongful discipline or demotion

- Invasion of privacy

Because EPLI coverage depends on your policy details, it’s important to review what’s included before you file a claim.

What’s not covered by Employers Practices Liability insurance?

EPLI generally does not cover employee claims related to:

- Wage and hour disputes or unpaid overtime

- Workers’ compensation or employee injury claims

- Civil or criminal fines, including punitive damages

- Bodily injury or property damage

- Independent contractors or 1099 worker disputes

- Equity compensation, stock options or benefit plan issues

These policies are written on a claims-made basis, meaning your insurance must be active when a claim is filed. Insurers typically require policyholders to maintain continuous coverage for protection to file a claim.

What's the difference between EPLI insurance coverage and Workers' Compensation insurance?

Workers’ comp insurance could help cover employee injuries or illnesses that happen on the job. EPLI insurance coverage could help protect your business from lawsuits related to workplace practices — like professional discrimination, harassment or wrongful termination — rather than physical injuries.

Does EPLI cover part-time or seasonal employees?

Depending on your policy, Employment Practices Liability insurance may help protect your business if part-time, seasonal or former employees file employment-related claims. Some policies may also extend coverage to job applicants or contract workers.

How do I make an EPLI insurance claim?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

ERGO NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought ERGO NEXT was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.