Commercial insurance agents focus on providing coverage to businesses. Typical policies include general liability, workers’ compensation, professional liability, commercial property, umbrella insurance, tools & equipment and more.

Personal insurance agents focus on lines for individuals or families. These might include homeowners, healthcare, personal auto and life insurance.

The two types of insurance agents

There are two basic types of insurance agents:

1. Captive agents

Captive agents work with a single insurance provider, usually a large national company. Because you work for an established company, you’ll receive guidance, support and training on the company’s products. And because you’re on the company’s payroll, you’ll have a stable salary to rely on more than an independent agent.

However, you are not allowed to sell competitors’ products and may be required to sign a non-compete agreement. You’ll also have to meet insurance sales quotas, which can be difficult and stressful. You may only receive commissions at many companies if you make a certain number of sales.

2. Independent agents

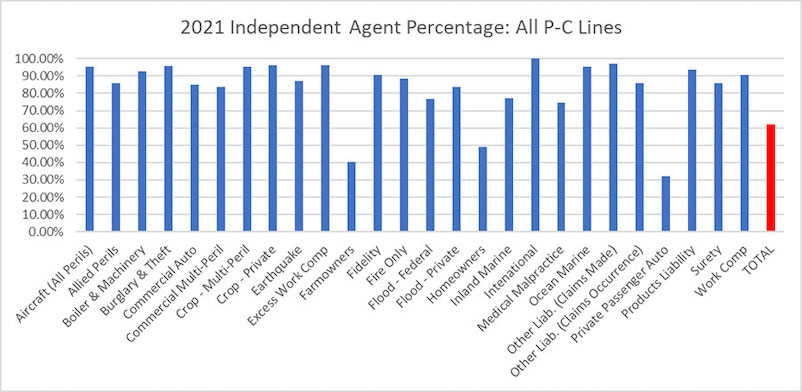

Independent agents work with multiple insurance providers. You will give your clients quotes from different insurers to help them find the right company and policy to meet their needs.

Independent agents have more flexibility but often receive little training or support from insurance companies. This can make it more challenging to get started. Still, you will have more flexibility in choosing the best options for your clients because you’ll have a more diverse product line to choose from.

Another significant advantage is income potential. According to the BLS, the median pay for insurance agents was $59,080 in 2023. But Glassdoor reports the estimated total pay in 2023 for an independent agent in the U.S. is $264,819 per year, with an average salary of $125,207 per year. Of course, this varies depending on your location, sales skills, work ethic, etc.

What’s required to become an insurance agent?

In the United States, selling insurance is a regulated activity. Anyone who wants to sell (or solicit or negotiate) insurance products must get an insurance license from their state’s insurance department.

Every state in the U.S. mandates an insurance license if you want to sell insurance. Plus, you must have the proper license for the type of insurance you want to advertise and sell.

For example, if you want to sell life insurance, you must obtain a license for that specifically. If you want to sell business insurance, you’ll have to get another license for that, too.

Individuals operating without a license could face stiff penalties and legal action, including jail time.

You need to fulfill a few requirements before you can become an insurance agent and start selling. One of the first steps is to become a licensed agent.

While insurance licensing requirements differ in every state, most places require you to:

- Be 18 years old

- Complete a pre-licensing education course or program

- Pass an insurance licensing exam

- Pass a background check

- Complete a license application and pay a licensing fee

It’s worth noting that a college degree isn’t often required to get a license.

Depending on what kind of insurance you want to sell, you may need to get multiple licenses.

How hard is the insurance license exam?

The exam and the test process aren’t too difficult, especially if you’ve completed the pre-exam requirements. Like most exams, the difficulty level depends on how prepared you are.

You may need to show proof that you’ve completed the pre-licensing course, so remember to bring any necessary documentation.

The exam is usually held at a testing site and on a computer. Questions are usually in multiple-choice format and will test you on insurance terminology, practical scenarios and numbers.

You will get your test results soon after taking the exam — often within a few minutes. If you pass, you’ll get instructions on applying for a license with the state. You can reschedule the exam if you don’t pass on your first try.

How often must an insurance agent license normally be renewed?

How often must an insurance agent license normally be renewed depends on where you live. Most states want you to renew every two years, but some might ask you to do it every year or every three years.

You’ll want to stay on top of your license expiration date so you don’t end up in a situation where you can’t sell insurance. Usually, you can start the renewal process 60 to 90 days before your license expires, but again, that can vary by state.

To help with the process, visit the National Insurance Producer Registry (NIPR) Licensing Center. It can help you navigate fees and figure out what regulations you need to follow when applying for your insurance license, renewing it, or making any changes.

What type of insurance is required to obtain an insurance agent license?

You’ll need an insurance broker license (or agent license) to talk about and sell insurance products to clients, but don’t forget about protection for you and your business. Here are insurance policies you might want when you get your insurance sales license.

Errors and Omissions insurance

When you get a license to sell insurance, you’ll do your best to offer your clients the right advice and service. But mistakes can happen, even when you aim to do everything by the book.

Maybe you forgot to renew a policy or accidentally set up the wrong coverage. If your client loses money because of an error or omission on your part, they may sue you. Errors and omissions (E&O) insurance can help protect you by covering legal costs and damages, even if the accusation is unfounded.

General Liability insurance

If you have an office where you meet with clients, there’s a risk that someone could get hurt on your property. They might slip, fall and break a bone. General liability can help pay their medical bills and protect you if you’re found liable.

This type of insurance can also help protect you if you accidentally damage someone else’s property or if someone claims you said something that hurt their reputation.

Workers’ Compensation insurance

If you have a team working for you, most states say you need to have workers’ compensation insurance. It’s there to help your employees if they get hurt or sick because of their job and can pay for their medical bills, missed wages, and even rehabilitation costs.

Commmercial Property insurance

Maybe you own or rent a small office where you work and meet with clients. Commercial property insurance could help protect your business equipment, furniture and structure from covered events such as fires or theft.

If you have to temporarily close, this type of insurance can help pay your expenses, such as rent or utilities, until you’re back on your feet.

Become an independent insurance agent: How to set up your small business in three steps

Congratulations! Now that you’ve passed the exam and are a fully licensed agent, the next step is to get your business up and running — this is how to become an independent insurance agent.

1. Choose a business structure

Once licensed, you must set up your insurance company, which requires choosing a business structure. It’s a good idea to consult with a tax professional or a business attorney because your choice will have long-lasting impacts on your company.

The most common structures for independent insurance agents are:

Sole proprietorship

A sole proprietorship is the simplest structure for a business owner who will not have partners. You can file taxes under your social security number or file for an EIN (employer identification number). You can file business deductions, profits and losses and your business taxes with your personal tax return. However, if your business is sued, you may be personally liable.

LLC

An LLC (limited liability company) may be the right choice for independent agents who want to limit personal liability or form a partnership with another agent. There is little paperwork, and your business profits and losses simply “pass-through” to the owners’ personal tax returns. An LLC can protect you against personal liability if the company is sued.

S corporation

S Corporations pay their employees a salary and deduct payroll taxes. Any excess profits can be distributed to the owners as dividends, with a lower tax rate than income. This can be advantageous in some cases. LLCs can elect to become S corporations through the IRS, though you will have additional paperwork requirements each year. Ask your tax professional if this election makes sense for your business.

There are additional state-specific guidelines for small businesses and IRS requirements. The IRS checklist for starting a business is a valuable resource to ensure you get everything. Also, consider working with a startup attorney to file your documents correctly.

2. Get appointed by an insurance company

Before you can sell a company’s products, you need to become appointed by the insurance company. This process typically involves applying for an appointment with each carrier you want to sell products for.

However, when you’re starting out, getting carrier appointments — especially at larger insurance companies — can be difficult since you don’t have a proven track record yet.

Some tips to help you:

- Start small. Try working with smaller insurance companies or carriers with a track record of working with new agencies. For instance, NEXT makes it easier to get appointed because we don’t have any production requirements to get started.

- Create a business plan. Sharing your business plan shows carriers you’ve thought things through and have a strategy compensating for lack of experience.

- Develop an online presence. Having a digital presence helps clients find you before they know you exist. It also helps them learn about your product knowledge and reputation before they choose to buy.

Hi, come work with us: NEXT Insurance allows appointed agents to quote and bind online for 1,300+ professions. We offer instant online quotes for all policies with no underwriting delays. Plus, we issue same-day logins for more sole proprietors and independent agents. Learn more and join us as an appointed agent.

3. Find clients for your insurance business

First, you need to figure out your ideal customers: families, corporations, small businesses or a combination of these groups.

Once you decide on a target audience, think about their daily habits. Does that person spend much time on social media? Is she a member of any local clubs or organizations? The better you understand your ideal clients, the easier to determine how best to market to them.

Remember that the insurance business is largely sales and that you may get a “no” five times before you get a “yes,” so you’ll need to follow up more than once.

It’s helpful to network in your community. Make sure you’re promoting yourself at the places where people who may need your insurance services are. Whenever possible, get prospects to fill out a contact form so you can follow up.

Fliers, business cards, events and TV ads are also great ways to reach prospective clients not already in your network.