What documents do you need for a Workers’ Compensation audit?

State requirements can vary, but your insurance company will likely want to see:

- Payroll summaries or reports

- W-2s, 1099s or tax forms

- Subcontractor certificates of insurance

- Quarterly tax filings

- Job descriptions or employee classifications

When you gather your payroll records, make sure to include all eligible payroll types — like wages, salaries, commissions and bonuses — since these are typically included in a workers’ compensation audit.

Having these records ready can make the audit faster and help avoid billing surprises. You can use this as your own workers’ compensation audit checklist — a quick way to stay organized before submitting payroll and tax documents.

While most insurers follow a similar audit process, NEXT simplifies it with online tools and guided reminders to help you finish your audit on time.

State-specific audit requirements

If you own a construction business in Florida or Oregon, there are exceptions for this workers’ comp audit process. State regulators will contact your business via phone and/or email to conduct an in-person audit.

- If your annual premium is over $10,000, your audit will be conducted in person.

- In Oregon only, if your annual premium is below $10,000, you will be randomly selected to participate in an in-person audit.

How does a Workers’ Comp audit work?

To complete your workers’ comp audit with NEXT, follow these three steps.

1. Log in to your account

NEXT will send you a reminder email when it’s time to conduct your audit.

Once you’ve been notified, log in to your customer account and follow the prompts to verify current payroll details for you, your employees, subcontractors and partners from your payroll and tax documents.

2. Email your documentation

After you complete the questions online, email copies of your documents to us at wc_auditors@next-insurance.com. Please include all of the following:

- Payroll reports from a payroll processing system

- Federal 1099, W-2 and W-3

- Federal Profit and Loss From Business Schedule C (Form 1040)

- Federal Employer’s Annual and Quarterly Tax Returns (Form 944 and 941)

- Federal Employer’s Annual Unemployment (FUTA) Tax Return (Form 940)

- COIs for subcontractors

Note that you should already have certificates of insurance for all subcontractors who worked for you to verify their own workers’ compensation insurance.

We only ask for COIs for subcontractors who were marked as insured in the audit questionnaire. If your subcontractors don’t have their own workers’ comp insurance, their compensation will be included in your payroll.

3. Wait for your audit review and results

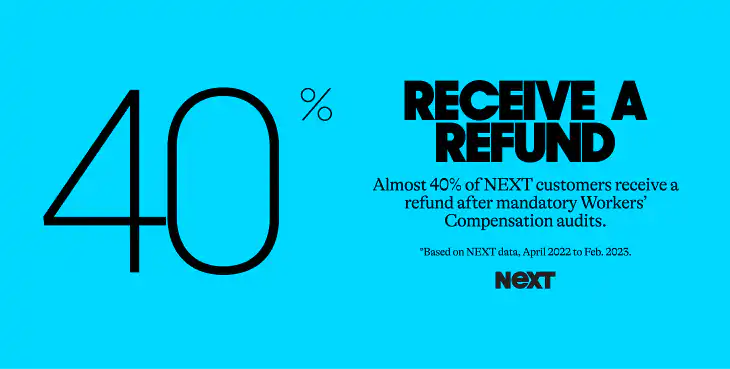

NEXT’s auditors will verify the information you provide and determine if a premium adjustment or refund are needed.

You should receive an audit summary within about a week. The results are usually one of three scenarios:

- If the payroll estimate was the same as your actual payroll, no further action is necessary.

- If the actual payroll is less than the estimate, your insurance costs decrease and we’ll issue a refund to the credit card we have on file within 30 days of sending the audit summary.

- If the actual payroll is greater than the estimate, we will change your policy to make sure you’re adequately covered for the year. You will be notified of the correct premium for the policy, and your business will have 30 days to review the additional cost for coverage. At the end of 30 days, we’ll charge the credit card we have on file for your account.

Updates on adjustments or refunds will also be available for your review if you log in to your customer account.

If there are no changes — congratulations! — you’re finished with your workers’ compensation audit until next year.

No matter the outcome, 30 days after the completion of the audit you will receive an email notification that the audit is complete. We’ll also provide updated policy documents for your records.

3 tips to simplify your annual Workers’ Compensation insurance audit

If you already have workers’ comp with NEXT, there are a few ways to make your workers’ comp audit even smoother:

- Keep your payroll estimate current. You don’t have to wait for audit season — you can log in to your online NEXT account anytime to update payroll or employee information during your policy term. This helps keep your premium accurate and up to date.

- Consider NEXT Pay-As-You-Go workers’ comp. With pay-as-you-go (PayGo) workers’ compensation, available only through our network of over 100 partners, including Intuit’s Quickbooks, Square, Gusto, Toast, Rippling, Patriot, OnPay, Homebase and more, your premium automatically adjusts based on your real payroll instead of estimates. That means fewer surprises during your annual audit — and payments that stay in sync with your business throughout the year.

- Review your audit summary early. After your audit is complete, review your summary as soon as it arrives. If you have any questions about premium adjustments or next steps, contact our support team at 855.222.5919 within 30 days of receiving your audit summary email.

Our team is here to help you understand your results and resolve any issues before any charges or refunds are applied.

What happens if you don’t do a Workers’ Comp audit?

Workers’ compensation audits are a required part of maintaining accurate coverage for your business. But as any business owner knows, calendars get crunched, to-do lists grow long and tasks can slip through the cracks.

If you don’t complete your workers’ comp audit, here’s what could happen:

- A non-compliance charge could be added to your policy. In some states, insurers may charge an additional non-compliance fee or estimate your premium based on higher payroll.

- Your active workers’ compensation policy could be canceled. This leaves your business potentially out of compliance with state laws.

- Your business could be reported as non-compliant to relevant state agencies. That can make it harder to secure workers’ comp coverage later or delay new policy approvals.

Complete your workers’ comp audit on time to keep your policy in good standing and help ensure your business is properly protected.