What is E&O insurance?

What can an E&O insurance policy cover?

- Business errors that cost clients money

- Claims of professional negligence

- Misrepresentation that causes financial harm

- Legal defense costs

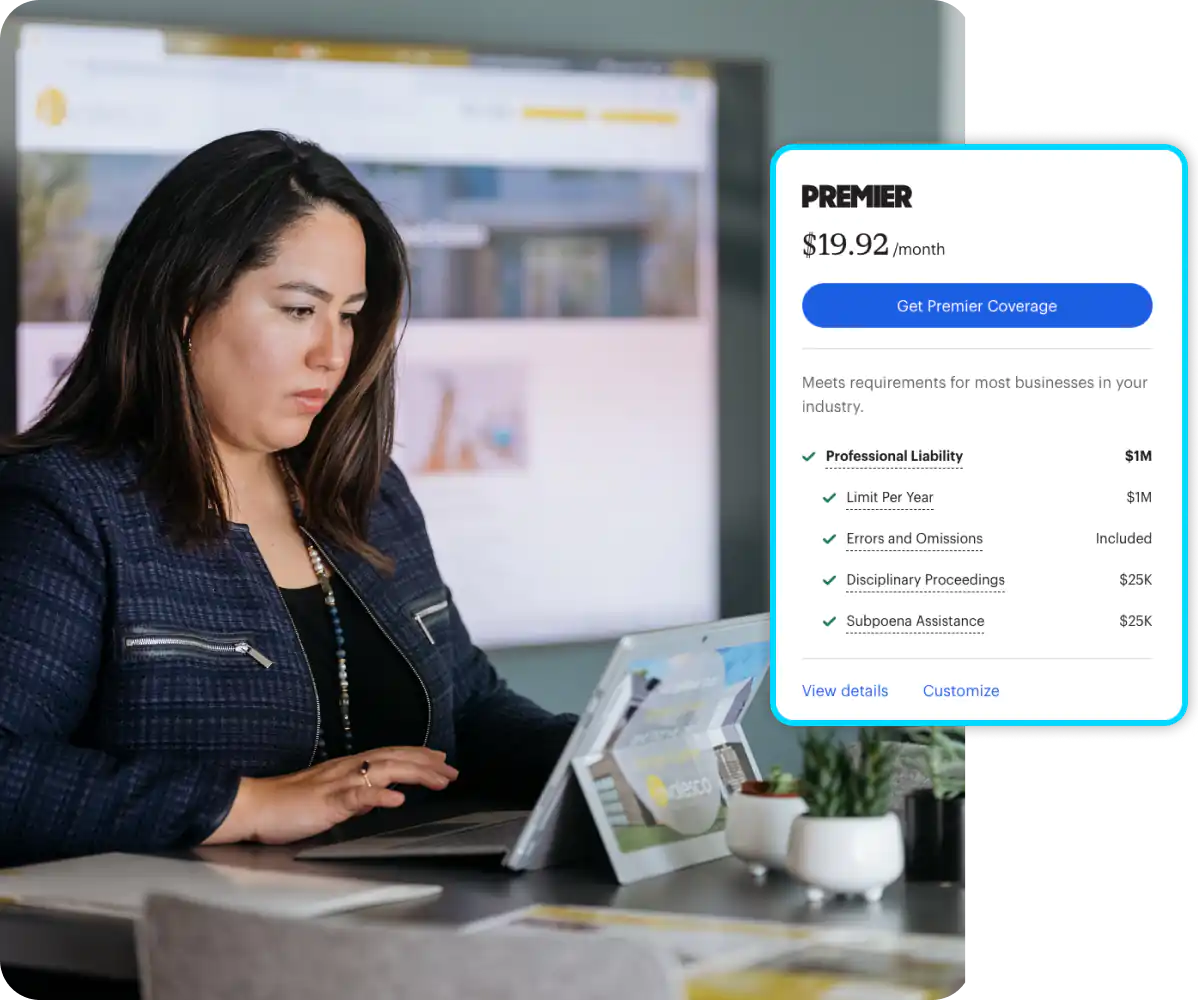

How much is Errors and Omissions insurance?

Starting at $19/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs an Errors and Omissions policy most?

- Insurance agents

- Real estate agents & property managers

- Travel agents

- Notaries

E&O insurance can help with the cost of professional errors — even if you’re not at fault

Business errors

A client or customer accuses you of making a professional mistake that costs them money.**

Claims of professional negligence

Someone claims professional inaction or wrongdoing caused a financial loss or harm.

Misrepresentation

Someone accuses you of providing inaccurate information with your services.

Legal defense costs

You need to hire a lawyer to defend your business after you’re accused of a professional mistake.

How much does E&O insurance cost?

Errors and omissions insurance policies can cost as little as $19/month† for some low-risk businesses.

Several factors influence the price you’ll pay for insurance, including:

- Your industry

- Your business operations

- The size of your business

- Where you do business

- Your business needs and how much coverage you choose

- Policy limits

How to get an Errors and Omissions insurance quote online

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for affordable E&O insurance.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately after payment. And your certificate of insurance is ready at no extra cost.

Who needs business E&O professional liability insurance?

Insurance agents

If your professional advice leads to a loss for your clients and you don’t carry insurance, your business could be responsible for the full cost of legal defense and settlements.

Real estate agents and property managers

If your client accuses you of failing to identify a property issue that leads to them seeking compensation for costly repairs, liability coverage could help cover some of your legal defense costs.

Travel agents

If a client claims that the hotel you booked was not as represented and they paid out of pocket for a new stay, professional liability coverage could help you defend yourself.

Notary public

A client alleges that you failed to properly record important paperwork and sues you for causing a financial loss. Your insurance could help cover the cost if your business is at fault.

E&O insurance FAQ (frequently asked questions)

Is Errors and Omissions insurance legally required?

E&O for small businesses could be required for some professional certifications and contract requirements.

However, it can depend on your profession and the state where you do business.

For example, a real estate agent might need to buy a real estate E&O policy and provide a certificate of insurance (COI) before signing on with a broker. Insurance agents often need to have coverage before they can work with an insurance carrier or agency.

Even if it’s not required, most businesses that provide a service or offer professional advice can benefit from the protections of E&O. It can help protect you from financial losses and it lets clients know that they may be protected if you make a mistake. This can help build trust and instill confidence in you and your employees.

Do real estate brokers need to carry Errors and Omissions insurance?

The rules for real estate brokers vary state to state. Check with your local real estate governing agency for the most up-to-date regulations.

Real estate E&O insurance is required in these states:

- Alaska

- Colorado

- Iowa

- Idaho

- Kentucky

- Louisiana

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- South Dakota

- Tennessee

Even if you don’t practice real estate in one of these states, E&O insurance could help your business. If you do face legal trouble, E&O insurance may help pay for your defense fees and judgments (up to your policy limits).

How do I make an E&O insurance claim?

You can file a claim anytime online or in the ERGO NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the ERGO NEXT app for iPhone or Android.

Can I add E&O if I already have General Liability insurance or other coverage?

Yes. ERGO NEXT can give you up to a 10% discount when you add a professional liability policy to your existing coverage.

You can add professional liability insurance directly through your customer account.

What’s the difference between E&O insurance and Professional Liability?

Although they go by different names, professional liability and errors and omissions insurance can both help protect you if you’re accused of making a professional error that leads to a financial loss for a client.

The name can be different depending on your industry.

- Professional liability coverage is usually the choice for accountants, consultants, engineers and architects.

- Errors & omissions insurance is the professional standard for real estate and insurance agent professionals.

Do you offer prior acts coverage?

It depends on your industry and business operations.

In some cases, we may provide prior acts coverage for businesses that have maintained continuous E&O liability coverage at similar or higher limits since the requested retroactive date.

Can I add an additional insured to my Professional Liability policy?

Yes, ERGO NEXT customers can easily add an additional insured and share their certificate of insurance through their customer account.

ERGO NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought ERGO NEXT was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.