5 steps to starting a handyman business in Maryland

1. Get the right license

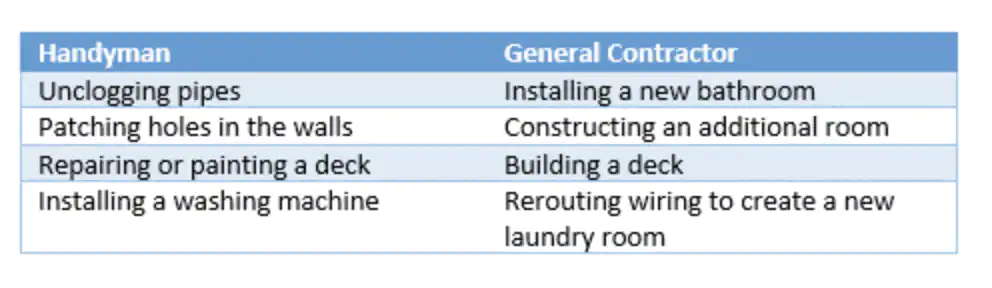

In Maryland, depending on the kind of work you’ll do, you’ll likely need a Home Improvement License, which you can get from the Department of Labor, Licensing, and Regulation. The Department has a list of the types of work that usually require licensing. (Not an exhaustive list.)

This license has you covered for a wide range of jobs. Whether you’re adding to a building, altering it, converting it, improving it, modernizing it, remodeling it, repairing it, or replacing it, you’re good to go.

But before you apply, there’s a licensing exam you’ll need to take and pass. This is done through: PSI Examinations.

When it comes to the license requirements, here’s what you’ll need to submit:

- Proof of at least two years of experience in home improvement work, construction and/or related education.

- Proof of financial solvency: a full credit report and net worth, a surety bond, or an indemnitor.

- Proof of current $50,000 liability insurance coverage.

- A certificate of trade name registration, where applicable.

The license should be renewed every two years.

2. Register your handyman business

When you set out to register any business in MD, you need to decide what type of business you’re setting up. Your options are:

- Sole proprietorship

- Partnership

- Limited liability company

- Corporation

Once you’ve made your choice, head over to the Maryland Business Express portal to register your business.

After your business is approved, you’ll get an SDAT number from the Department of Assessments and Taxations. This is a unique identifier for your business. It starts with a letter — D, F, W, L, T or Z.

Just a heads up: this SDAT number isn’t the same as a FEIN/EIN number from the IRS. But we’ll get to that later.

3. File a trade name

A trade name is also known as a fictitious name, an assumed name, or Doing Business As (DBA).

If your business operates under a different name than its legal one, you’ll need to file a trade name. You can do this online through the Maryland Business Express portal. If you prefer, you can download the Trade Name Application form, fill it out, and mail it to:

Charter Division Department of Assessments and Taxation 301 W. Preston Street, Room 801 Baltimore, MD 21201

You can reach the Maryland Department of Assessments and Taxation at 410-767-1350.

Filing a trade name in Maryland costs $25. If you’re in a hurry, you can pay an extra $50 for expedited service.

4. Get an employer identification number (EIN)

If you’re a sole proprietor with no employees, you might not need an EIN. But if you’re hiring or if your business is a partnership, an LLC, or a corporation, you’ll need an Employer Identification Number (EIN). You can get this from the IRS website.

Keep in mind, that the EIN is different from the SDAT number. The SDAT number is given by the Maryland Department of Assessments and Taxation for identifying your business. The EIN, on the other hand, is given by the IRS for tax purposes.

5. Register for taxes and applicable insurance

Depending on your type of business, you will have different taxes and obligations. Check the Maryland Comptroller Office website for info on different taxes, filing forms, and tax updates.

As for the insurance, Maryland mandates the following insurance for handymen businesses:

Local handyman business license requirements

Besides checking handyman business license and insurance requirements in Maryland on a state level, you also want to learn about the local requirements.

Washington DC

Planning to be a handyman in Washington DC? First, you’ll need a DC-specific Home Improvement Contractor license. Next, you’ll need a Basic Business License. You can apply for this online through the DC Business Licensing Portal or in person at the DLCP Business License Center.

You’re also required to have a surety bond of at least $25,000.

Don’t forget about liability insurance. You’ll need coverage of $50,000 for injury or death of one person per accident, $100,000 in total for more than one person per accident, and $10,000 for property damage per accident.

If you’re hiring, workers’ compensation insurance is a must. Even if you’re a sole proprietor, it’s recommended to have this insurance. It can cover potential workplace injuries and lost wages.

Baltimore

In Baltimore, many of the tasks you’ll need to accomplish can you’ll need the statewide Home Improvement License to perform most home improvement or maintenance jobs.

Maryland handyman business insurance requirements

Having handyman business insurance in Maryland is an important step in launching your business. Besides covering the insurance requirements, a good policy will secure your business and demonstrate credibility to clients.

General Liability insurance

This type of insurance helps pay for expenses related to property damage and other accidents that could happen while working as a handyperson. Maryland Home Improvement License applicants must provide proof of at least $50,000 in general liability insurance coverage.

Workers’ Compensation insurance

Most Maryland employers must submit proof of workers’ compensation insurance coverage. This insurance can help cover medical expenses and lost wages for employee injuries on the job.

Any business owner can apply for workers’ comp insurance even if they are not required to by state law. For example, an individual business owner with no employees can also benefit from this type of coverage if they get hurt at work.

Tools and Equipment insurance

If damage or theft affects your work gear, tools and equipment insurance can help cover repair or replacement costs.

Commercial Auto insurance

Most handypeople need commercial auto insurance since they regularly drive to different job sites. This insurance helps pay for accident-related expenses, such as towing, repairs and rental reimbursement.

All Maryland vehicles must be insured at all times. Your vehicle insurance must cover, at a minimum:

- $30,000 for bodily injury

- $60,000 for two or more people

- $15,000 property damage

Commercial Property insurance

If you own or rent business property for your business, commercial property insurance can help pay for costs related to damage or vandalism to the property or the inventory or equipment stored there.

Get your business covered with NEXT

NEXT can help you get your business off the ground with our options for handyman business insurance that’s guaranteed to be fast and affordable.

All it takes is a few minutes to fill out our online application, customize your options and obtain your proof of insurance.

What are you waiting for? Get your free online quote today.

Do you have projects in another U.S. state? Learn what states require handyman licenses in our summary of handyman license requirements.

This information has been provided as a service. It is correct and up-to-date to the best of our knowledge; however, it is in no way intended to offer legal advice and you must always consult with local authorities before you make any business decisions. Regulations and requirements may change at any time.