Chicago general contractor license fees

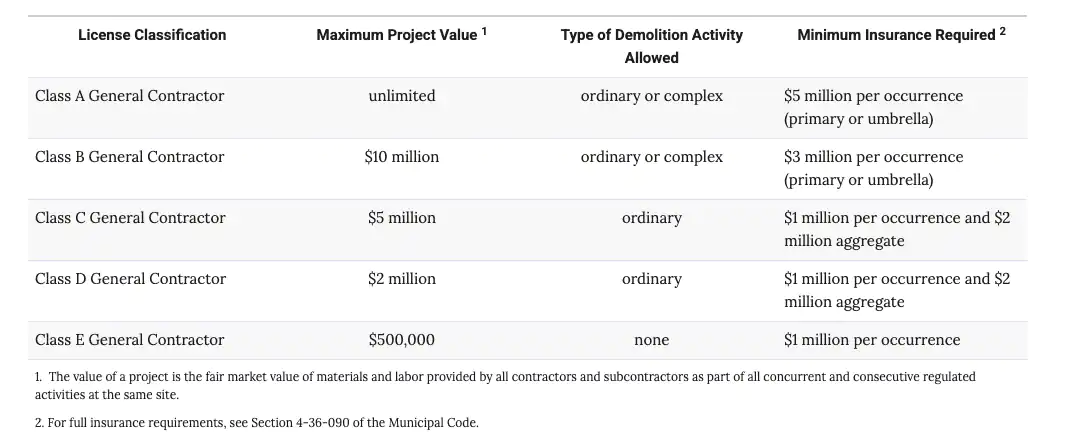

The major difference between classes is the amount of insurance required for each classification. There are five license classifications in Chicago. Depending on the cost of the projects you are working on, there are different fees and insurance minimums for each classification.

The classes and fees are:

- Class A General Contractor: A $2,000 fee for projects with unlimited value, and a minimum insurance of $5 million per occurrence (primary or umbrella) is required.

- Class B General Contractor: A $1,000 fee for projects up to $10 million; the requirement is $3 million per occurrence (primary or umbrella).

- Class C General Contractor: A $750 fee for projects up to $5 million; insurance requirements are $1 million per occurrence and $2 million aggregate.

- Class D General Contractor: A $500 fee for projects up to $2 million; insurance requirements are $1 million per occurrence and $2 million aggregate.

- Class E General Contractor: A $300 fee for projects up to $500,000; insurance requirements are $1 million per occurrence.

Contractor license renewals in Chicago

Licensed contractors must renew each year through Continental Testing Services. Be sure to begin the process of renewing your contractor license 90 days before it expires. In Chicago, the process for general contractor license renewal includes these steps:

- Complete and sign the renewal form.

- Obtain an updated certificate of insurance.

- Provide a signed copy of the Chicago general contractor license affidavit.

- Provide the business structure documents.

- Write a check for the annual registration fee.

- Mail the package.

Aurora contractor license requirements

If you’re a general contractor looking to set up shop in Aurora, here’s what you need to know. You’ll need to fill out and submit a Contractor Registration Application to get your license. (This is different from a Public Works Contractor, which requires a separate license.)

Depending on the type of work you’ll do, you may also need to provide these supporting documents:

- State of Illinois license/registration

- License/Certificate from the municipality where tested

- Certificate of Insurance & Workers’ Comp

- Business card

- Bond information

If you’re planning to do electrical or mechanical work, the city recognizes certifications from the International Code Council (ICC). This includes categories like Standard Master Electrician and Master Mechanical Certification. Otherwise, you must sit for a contractor test.

You’ll need to provide a certificate of insurance for general liability insurance with Aurora as the primary and non-contributory additional insured. Your policy should cover at least $1,000,000 general aggregate with $500,000 per occurrence. You’ll also need to have workers’ comp insurance, as required by Illinois state laws.

If you are registering for a dumpster license, Aurora contractors must have a surety bond in the amount of $5000. The bond must be valid for a minimum of one year.

Joliet contractor license requirements

In Joliet, general contractors must register with the Building & Inspectional Services Division and prove they are insured, licensed and bonded for their respective trades. There is no fee to register.

- Contractors installing or maintaining signage need a Sign Erector’s License.

- HVAC contractors must pass a city-administered HVAC exam, even if they hold a state-recognized license.

Additionally, a letter of intent is required for each electrical, plumbing and HVAC subcontractor on projects, as part of the registration process.

As for insurance, the contractors need to include a certificate of insurance with general liability coverage. This requirement applies to plumbing, HVAC, electrical and roofing contractors.