It happens. You may decide it’s time to leave us. We’re sorry to see you go, and we hope you’ll come back soon. But in the interim, this is how to cancel your NEXT Insurance coverage.

Jump ahead to learn more about:

It happens. You may decide it’s time to leave us. We’re sorry to see you go, and we hope you’ll come back soon. But in the interim, this is how to cancel your NEXT Insurance coverage.

Jump ahead to learn more about:

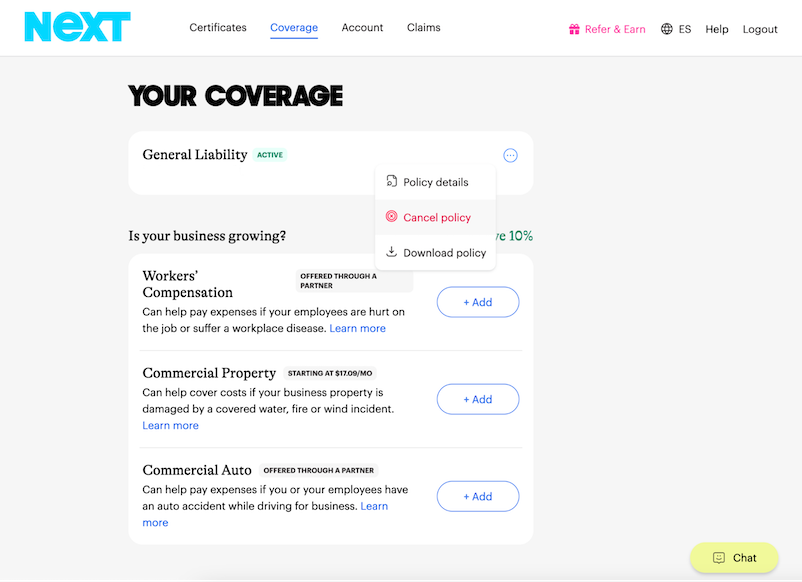

If you bought your insurance directly from NEXT and you’d like to cancel your policy, here’s how:

Important note. You can only cancel one policy at a time. For example, if you have general liability and workers’ comp insurance, you must go through these steps for both policies.

Yes, you don’t have to cancel everything — at NEXT you can create customized coverage to fit your needs.

Just go through the cancellation process outlined above with the one policy you would like to cancel. You’ll receive a confirmation email for each policy cancellation and a prorated refund within a few business days.

We can’t pause policies, but you can cancel your policy anytime without penalty.

If you cancel, you can reinstate your policy within 30 days through your NEXT customer account. After 30 days, reinstatement is no longer possible, and you’ll need to get a new quote and sign up again.

To reinstate your NEXT insurance coverage:

Or follow these instructions to learn more.

Even a brief insurance coverage gap can expose your business to risks and potential legal or financial liabilities. Continuous coverage ensures protection against unexpected incidents and compliance with industry regulations.

Beyond safeguarding your business, maintaining continuous insurance coverage can benefit your bottom line. Insurance companies may reward a long, consistent coverage history with lower rates. In contrast, gaps or inconsistencies in coverage can lead to higher premiums.

Before you cancel, we want to recap some of the great benefits you’ll miss. NEXT products and services offer:

NEXT specializes in small business insurance. We aim to help your business thrive, recover from a setback or gain new business. Our support team is standing by if you have questions or need help finding the right coverage.

If you need assistance, we’re here to help. You can reach our U.S.-based insurance professionals two ways:

Business hours for our support team are Monday–Friday, 8:00 a.m.–5:00 p.m. CST.

Read NEXT’s Knowledge Center, FAQs, or our resources page for quick answers.