More insurance coverage should mean more confidence for small business owners, right?

Not exactly — at least, not yet.

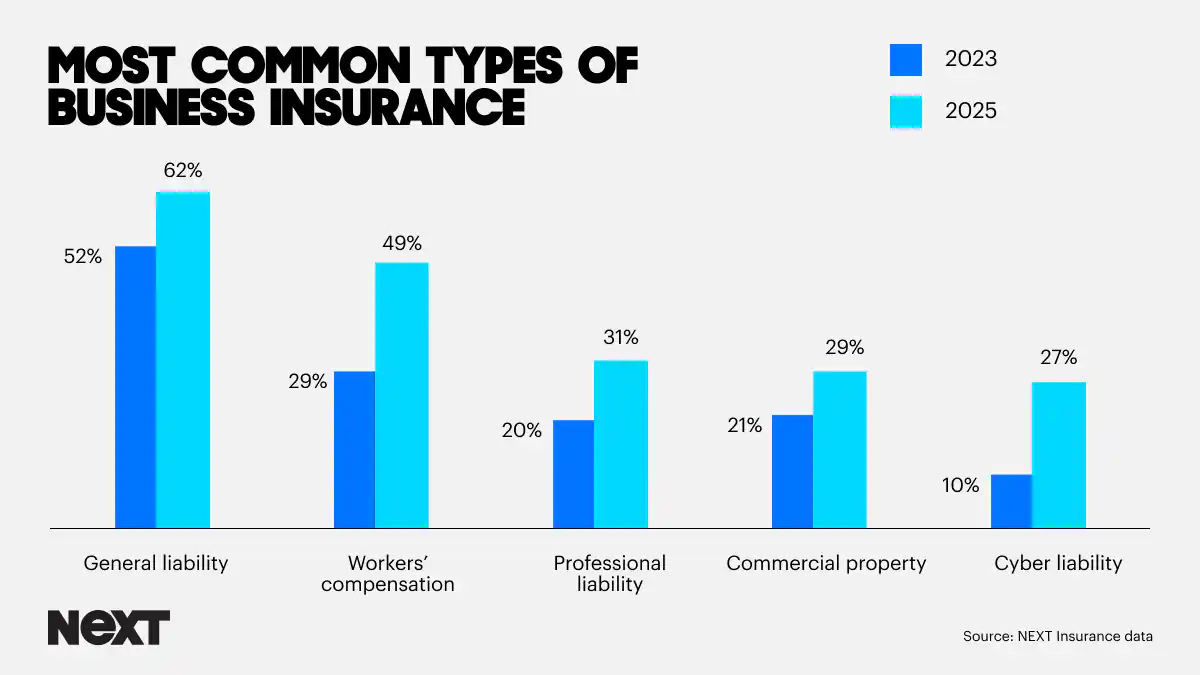

According to a NEXT survey of small business owners, insurance adoption is up across the board but confidence hasn’t caught up.

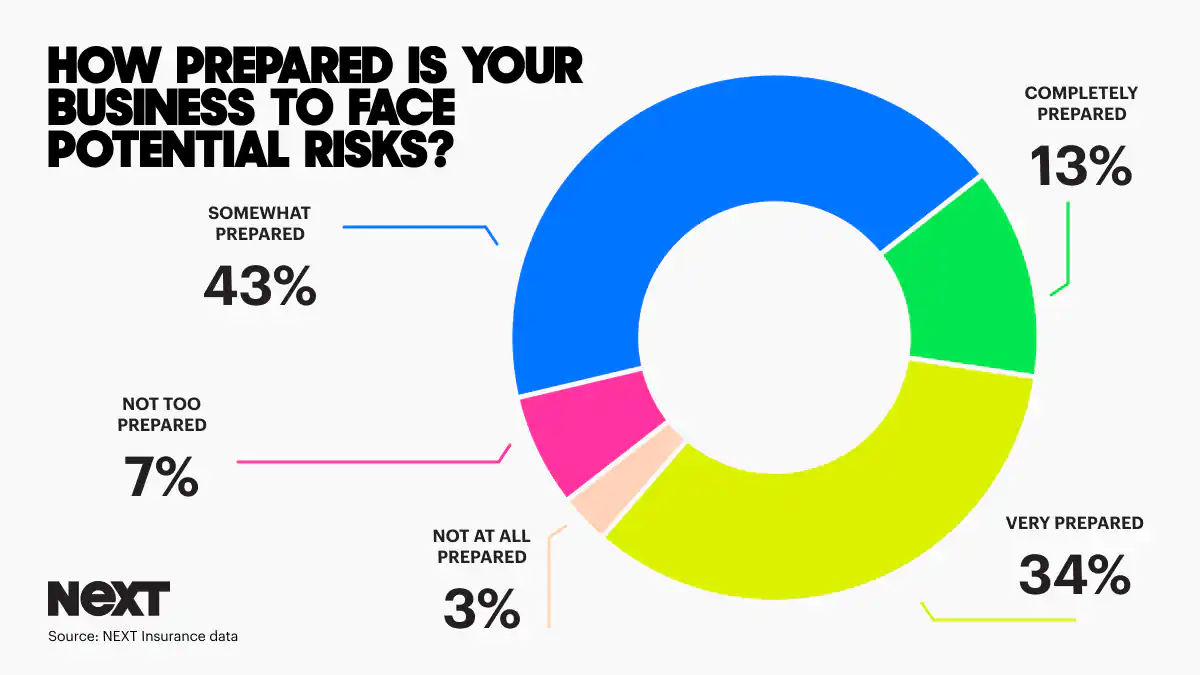

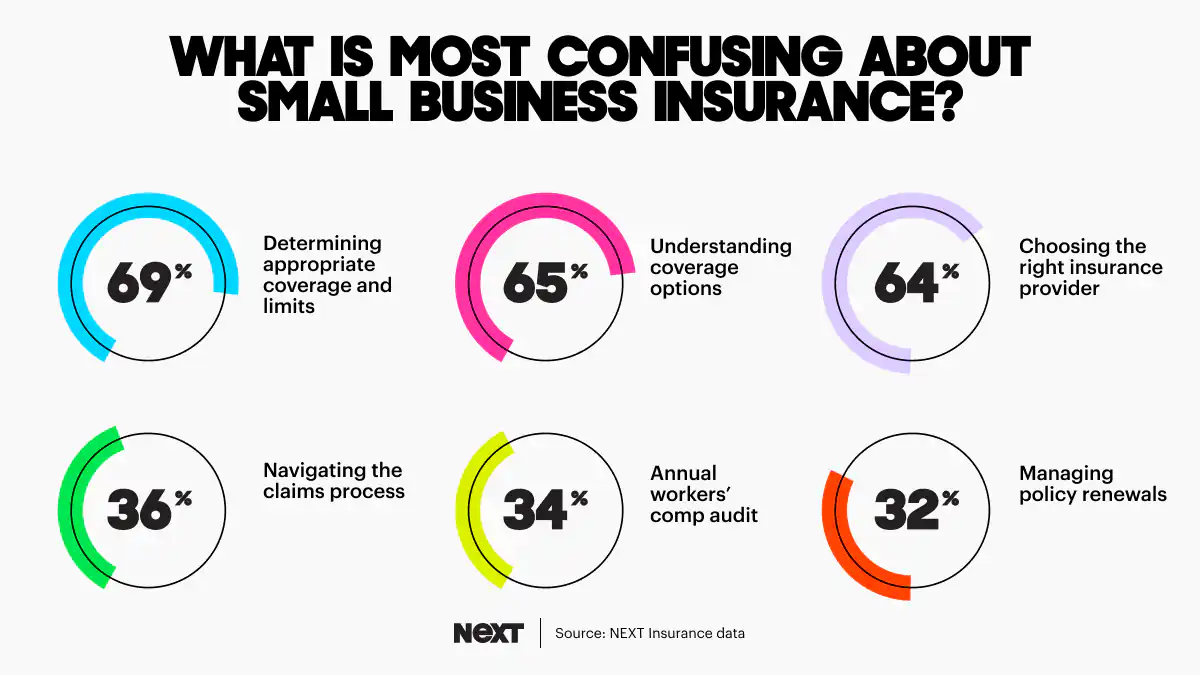

Despite more business owners having small business insurance coverage, many still feel unprepared to face real-world risks, and a majority say they find insurance confusing.

This year’s survey, a follow-up to our 2023 industry pulse check, sheds light on how small business owners are thinking about and managing risk. The results reveal a mix of progress but also persistent gaps, especially when it comes to understanding coverage and choosing the right policies for unique business needs.

Top takeaways from this year’s survey of 500 business owners include:

- 92% of small businesses have business insurance

- Only 13% of small businesses with coverage feel fully prepared for risk

- Professional mistakes top the list of business risks

- The biggest reason small businesses invest in insurance is to protect against financial loss

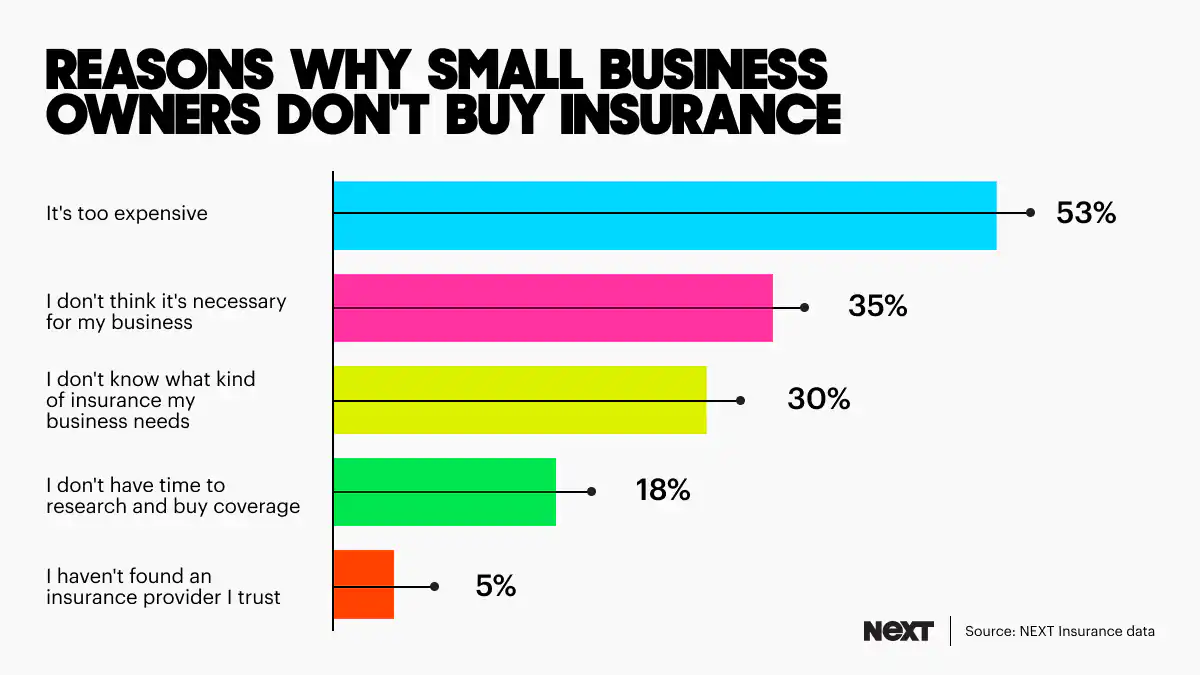

- Both cost and confusion prevent small businesses from getting insurance

- 69% of small businesses struggle to understand coverage, limits and policies

- 87% of small businesses trust their insurer