What is Commercial Umbrella insurance?

What can Commercial Umbrella insurance cover?

- Slip-and-fall injuries

- Damage to other people’s property

- Legal fees and defense costs

What does Commercial Umbrella insurance cost?

Starting at $25/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs Commercial Umbrella protection most?

- Businesses required by a lease or contract

- Businesses that could damage expensive property of others

- Businesses that manufacture, store, rent or sell anything dangerous

Extend General Liability limits up to $4 million for these common business risks

Injuries

Your business is at fault for an injury to a non-employee on your business premises.**

Property damage

You or your employees accidentally damage someone else’s property.

Medical payments

Someone other than an employee sues your business for medical reimbursement.

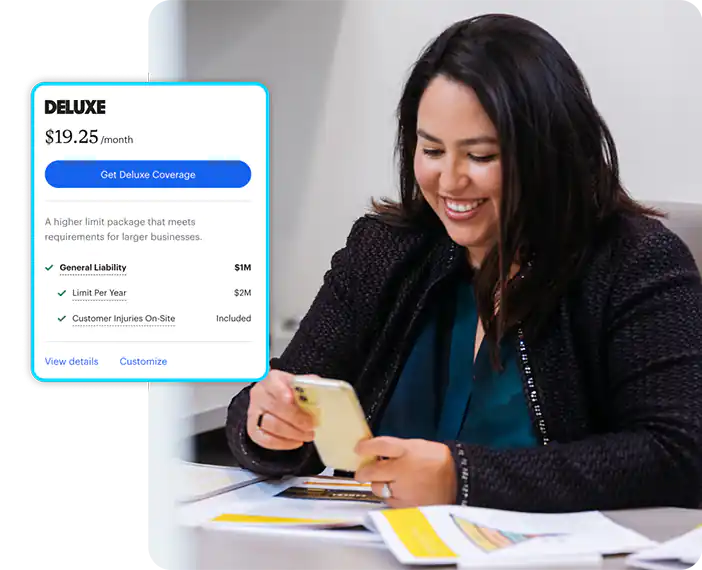

How much does Commercial Umbrella insurance coverage cost?

You must have a ERGO NEXT general liability policy to add commercial umbrella insurance. You can choose either $1 million or $2 million of coverage and adjust your limit to meet your business needs.

Several factors influence the price you’ll pay for commercial umbrella insurance, including:

- Your industry

- Your business operations

- The size of your business

- The state where you do business

- Your business needs and how much coverage you want to purchase

How do I get Commercial Umbrella insurance?

Tell us about your business

In about 10 minutes you’ll see the exact price you’ll pay for general and commercial umbrella liability and other policies.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately after payment. And your certificate of insurance is ready at no extra cost.

Who needs a Commercial Umbrella insurance policy?

Construction and contractors

General contractors and other construction professionals are often required to have commercial umbrella liability policies for professional licenses or to work on certain jobs. Business umbrella insurance can also extend the limits of your liability for property damage or bodily injury.

Restaurants and food service

Injury and accidents can be a risk for a restaurant business, catering company or other food and beverage services. A commercial umbrella policy could help cover damage costs for others’ property and lawsuit expenses. Some businesses may also want to add liquor liability for more coverage.

Retail and online retail

Retail business owners in busy locations can benefit from the legal protection commercial umbrella insurance can provide in the event of a customer injury. ERGO NEXT policies also include some protection for product liability if one of the products you make or sell causes damage that costs a customer money.

Cleaners and janitors

Commercial umbrella insurance coverage can protect business and residential cleaning services from financial losses if they accidentally break or damage property — such as artwork, furniture or computer equipment — on the job.

Commercial Umbrella insurance FAQ (frequently asked questions)

Is Commercial Umbrella insurance required?

Yes, in some circumstances.

Some clients and agencies require a certificate of insurance that includes $2 million in coverage or more before they’ll work with you. A commercial umbrella policy on top of your ERGO NEXT general liability policy may help satisfy this requirement.

If you want to rent a property for business, some landlords require you to carry umbrella commercial insurance as part of your commercial lease.

How does Commercial Umbrella insurance work?

ERGO NEXT’s umbrella insurance, also called excess liability insurance in some states, offers a higher limit (the maximum amount your insurer will pay for a claim) than general liability insurance alone.

If you file a claim on your small business insurance, the limit of your general liability policy must be exhausted first. If the loss exceeds your general liability limits, then the umbrella coverage could kick in as an extra layer of liability protection to cover additional losses up to the excess limit.

Business umbrella insurance can help protect you from unexpected expenses that can affect your business and lead to lawsuits, such as:

- Damage to another person’s property

- Injuries to non-employees

- Advertising harm

- Accusations of libel or slander (personal injury or reputational harm)

A business umbrella policy can add up to an additional $2 million beyond your existing ERGO NEXT general liability policy limit. Coverage with both would be up to $4 million.

For example, let’s say there’s a $2 million judgment against your business for covered damages. If your general liability policy limit is $1 million, that insurance will cover the cost of the first million dollars in damages. Your business umbrella policy could then kick in to cover the additional $1 million in damages to make you whole.**

Note that in Illinois, Nevada, New York, Texas, Utah, Colorado, Pennsylvania and Mississippi ERGO NEXT uses the term “excess liability insurance” rather than commercial umbrella.

How do I get Umbrella insurance for my small business?

You can buy a commercial umbrella policy and get your certificate of insurance (COI) in about 10 minutes, 100% online with ERGO NEXT.

You must have a ERGO NEXT existing general liability policy to add umbrella coverage. If you don’t, learn more about general liability insurance and sign up for both.

Does Commercial Umbrella insurance cover property damage?

A commercial umbrella insurance policy could cover expenses related to property damage, but only for property that does not belong to you.

Commercial property insurance can help protect your physical items you use to operate your business, such as:

- Inventory

- Business equipment

- Furniture and furnishings

- Physical structures

Does Commercial Umbrella insurance cover vehicles?

ERGO NEXT commercial umbrella coverage does not cover automobile liability or any expenses related to business or personal driving.

Commercial auto insurance can help cover expenses If you drive for business reasons, such as:

- Injuries if you’re responsible for an accident

- Property damage to other people’s property

- Repairs for your vehicle

- Towing and rentals if your vehicle is damaged

Does Commercial Umbrella insurance cover theft?

Small business umbrella insurance doesn’t cover the theft of your own possessions. But it might cover the theft of customer property.

Let’s say you’re repairing a garage door for a homeowner and someone steals her car while you’re working. An umbrella insurance policy could help pay if you’re found liable for the loss.

If any of your personal or business items are stolen, you won’t be covered without additional insurance.

Businesses like contractors or a cleaning business might consider tools and equipment insurance to help protect their goods if they’re damaged or stolen on the job.

Does Commercial Umbrella insurance cover employee injuries?

Umbrella commercial insurance can help pay for expenses if your business is accused of causing an injury to a non-employee, but injuries to you or your employee are not covered.

Workers’ compensation insurance could help pay for medical expenses and lost wages if an employee is hurt on the job.

Many states legally require you to buy workers’ comp as soon as you hire an employee. Business owners can also be covered if they get hurt while working if they buy optional business owner’s coverage.

Is Commercial Umbrella insurance tax deductible?

Umbrella insurance premiums can typically be deducted from your taxes. It’s important to consult with a licensed accounting professional to make sure you qualify.

The IRS categorizes payments you make for this type of insurance to be both an “ordinary and necessary” business expense. Be sure to keep a file of how much you pay every year for your policy.

How do I make a Commercial Umbrella insurance claim?

You can file a claim anytime online or in the ERGO NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

How much Commercial Umbrella insurance do I need?

Small business insurance isn’t one-size-fits-all. Each business is unique and has different insurance needs.

The coverage you need depends on a number of factors, including:

- The type of work you do

- Your level of business risk

- How many employees and subcontractors you have

- The state where you work

- Your history of claims

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the ERGO NEXT app for iPhone or Android.

ERGO NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought ERGO NEXT was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.