Small businesses are the lifeblood of America. While there is no shortage of major U.S. companies with worldwide name recognition, the American economy truly runs on the millions of small businesses in our communities.

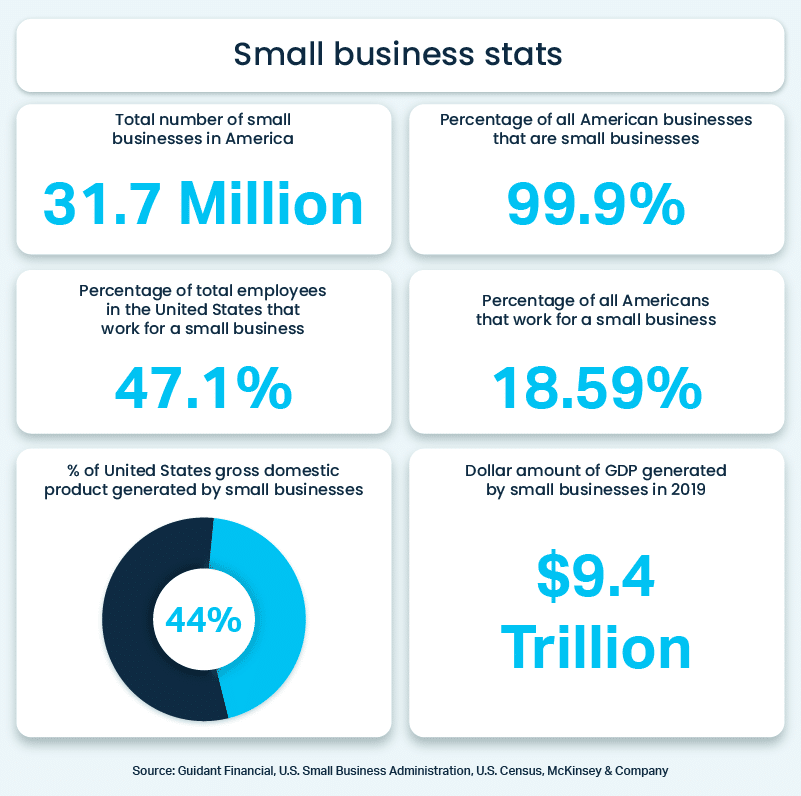

Small businesses with one to 500 employees make up 99.9% of all businesses in the United States, according to the Small Business Administration. They employ over 47% of the workforce, and minority-owned businesses are an increasingly important factor with this part of the economy.

These businesses are the general contractor adding a deck to your neighbor’s house, the Main Street boutiques selling local goods, and the friendly coffee shop owner offering teens their first paycheck.

Small businesses also include larger organizations that employ more people, such as fitness centers, construction management firms and regional landscaping companies.

As the coronavirus pandemic continues to disrupt our economy, these small businesses are also the most vulnerable. They typically don’t have the financial safety net that large corporations have.

Shelter-in-place orders have led to permanent closures, layoffs and major changes to operations. Yet, many small business owners also remain optimistic.

In this report, we’ll share details on the importance of small businesses in the United States and what could be at stake if they don’t recover from the pandemic. Through interactive maps, infographics and other important data points, we’ll provide information on:

How many small businesses are in the U.S.

- How many people work at U.S. businesses

- Small business growth by state pre-COVID

- Small business payroll by state

Minority-owned businesses in the U.S.

How small business owners are responding to COVID-19

How many small businesses are in the United State?

There are over 31 million small businesses in America, employing millions of people and contributing over $9 trillion to the nation’s gross domestic product. That number represents 44% of America’s overall GDP, which demonstrates just how important small business is to the entire U.S. economy.

To show how prevalent small businesses are across the country, we gathered data on how many were located in each state before the pandemic. Click on different states in the interactive map below.

Key takeaway: There are at least 68,000 active small businesses in every state.

To help compare states, we calculated how many small businesses are in each state for every 100,000 people, which allows us to assess small business density since it accounts for total population differences.

Florida takes the top spot in this metric, with almost 13,000 small businesses per 100,000 people, making the Sunshine State the place where small businesses are most prevalent.

How many people work at U.S. small businesses?

Click on each state in the interactive map below to see the number of people who work at small businesses in each state and the percentage of that state’s active workforce that is employed by a small business.

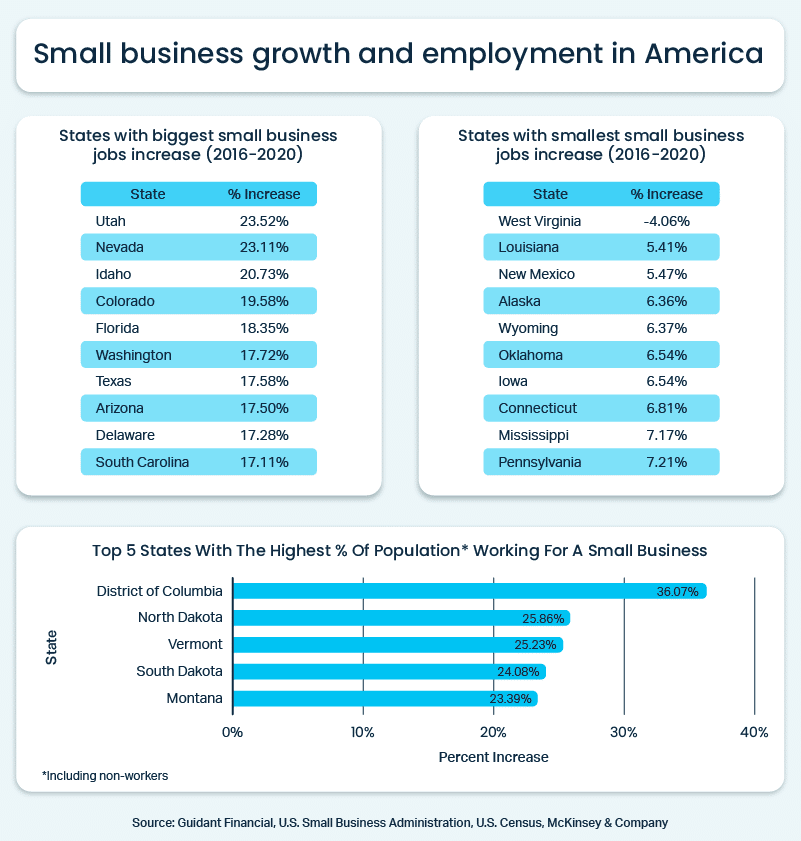

Key takeaway: States with smaller populations tend to have a higher percentage of people who work at small businesses compared to more populated states.

The percentage figures show how important small businesses are in places with smaller populations, such as Montana and Wyoming. While those states are home to just 245,758 and 128,883 small business employees, respectively, those numbers represent 65.3% of Montana’s total active workforce and 63.8% of Wyoming’s employees.

Comparatively, New York has over 4.1 million small business employees and California boasts 7.2 million, but those numbers account for 49.8% of New York’s total workforce and 48.5% of California’s employees.

The data also reveals that the importance of small business employment is generally more pronounced in northern states. We found 16 different states where more than 50% of the active workforce is employed by small businesses, and of those 16 states only three — Oklahoma, Hawaii and Louisiana — are located in the southern part of the country.

Small business growth by state pre-COVID

The danger the coronavirus pandemic poses to all small businesses in America is clear, and it becomes even more relevant when tracking their contribution to overall job growth in recent years.

Only time will tell how this growth will be impacted as the coronavirus continues to force small businesses to stop work and make significant adjustments to their operations.

From 2016 to 2020, the 10 states with the highest employment growth all saw increases in excess of 17%. Only West Virginia (-4%) saw a decrease in small business employment.

Small business payroll by state

We examined payroll data from every state to illustrate the importance of small business employment in each state. Click on each state in the interactive map to see payroll figures and use the dropdown menu to see total payroll for different sizes of small businesses.

Key takeaway: Small businesses in the most populated state (Texas, New York and California) each produce over $200 billion in payroll annually.

Beyond the total revenue small businesses contribute to America’s gross domestic product, the money that is pumped into local economies through employee pay is crucial to the health of the nation’s economy.

Small businesses pay their employees over $2.7 trillion annually.

Minority-owned businesses in America

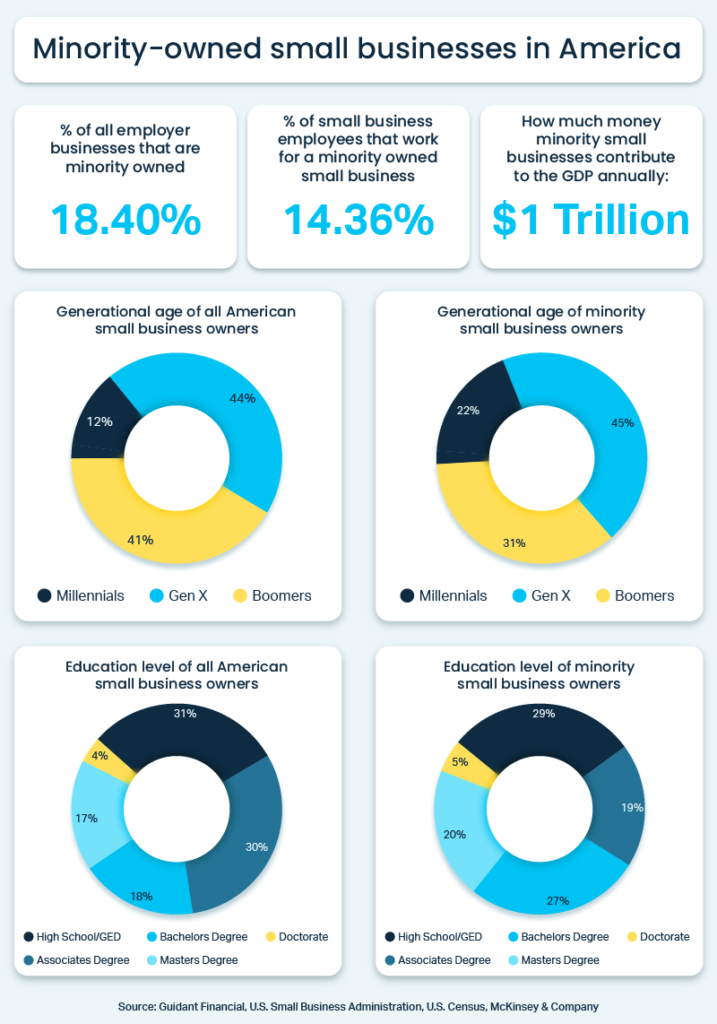

Small businesses in the United States are nearly as diverse as the population as a whole. Minority-owned businesses play an important role by contributing $1 trillion to the economy annually.

Minority-owned small businesses are a crucial part of the overall small business landscape. They represent almost 20% of all small business employers, according to the most recent data available from McKinsey and Company.

Demographic data reveals that minority small business owners are generally younger — 22% are millennials, compared to just 12% of all small business owners.

Additionally, data shows that 52% of minority small business owners hold a bachelor’s degree or higher compared to 39% of small business owners as a whole.

Minority-owned business growth

Minority-owned small businesses have already established themselves as an important part of the business landscape, and data shows that minority small business ownership was experiencing sustained growth before the pandemic.

In the last five years, minority small business ownership has increased in 45 of 50 states, representing an 11.58% increase in minority small business ownership.

By comparing census data on the characteristics of small business owners from reports compiled in 2012 and 2017, we were able to map out the percentage of minority small business owners in every state and the percentage change over that five-year period. Use the drop-down menu to change metrics.

Key takeaway: 11 different states experienced an increase in minority small business ownership of 20% or greater between 2012 and 2017.

Minority-owned businesses by ethnic group

We were also able to use data to explore the percentage of small business owners from different ethnicities in every state. Use the dropdown to see the percentage of businesses owned by different minority groups in each state.

Key takeaway: In 11 different states, over 20% of all small businesses are owned by minorities in 2017: Hawaii, California, Washington, D.C., Texas, New Mexico, Florida, Maryland, New Jersey, New York, Georgia, and Virginia.

Our analysis found that Hawaii has the highest percentage of total minority small business owners (53%) and Asian small business owners (48%), New Mexico has the highest percentage of Hispanic small-business owners (19%), and Washington, D.C., has the highest percentage of African-American small business owners (12%).

How small business owners are responding to COVID-19

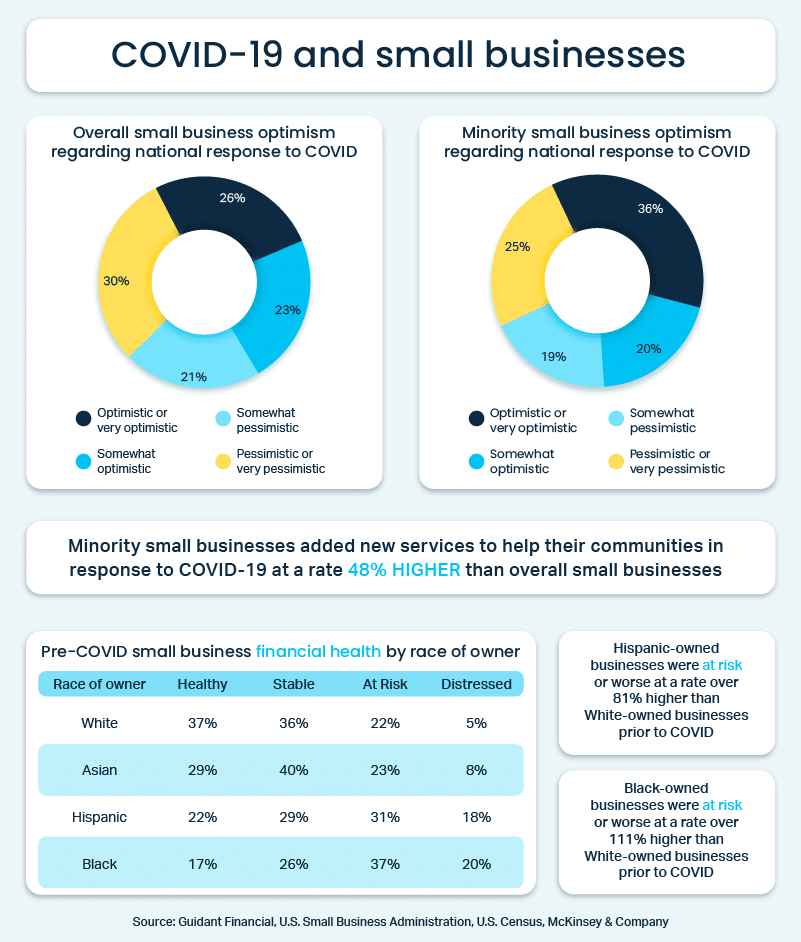

Even with uncertainty and mixed feelings about the government’s response to COVID-19, many small business owners remain optimistic about the future of their businesses.

Part of the reason our team wanted to spotlight minority-owned small businesses is that the current COVID-19 pandemic presents a significant threat to these kinds of businesses, beyond the unprecedented danger the virus poses to small businesses in general.

The financial health of a small business includes many different components, including things like profitability, sustained earnings and credit scores.

Data indicates that Hispanic-owned small businesses were classified as “At-Risk” or worse at a rate 81% higher than white small business owners. The risk level was over 111% higher for Black business owners.

Despite the fact that minority-owned businesses were facing a significant challenges even before the pandemic, 56% of minority business owners who were recently surveyed about America’s response to the virus expressed optimism, compared to 49% of overall small business owners.

A recent study found that minority-owned small businesses are working hard to adapt and improve their offerings during the pandemic. Those businesses added new services at a rate 48% higher than small businesses as a whole.

COVID-19 threatens the health and future growth of small businesses in America, and that is a threat that cannot be taken lightly. Small businesses account for nearly all of America’s total businesses, employ nearly half of America’s workforce and generate trillions of dollars towards the nation’s gross domestic product.

We hope that you have a better understanding of the role small businesses play in America and know just how important it is to protect and patronize them now and in the future.

How Next Insurance helps small business owners

Next Insurance is 100% dedicated to helping small business owners and the self-employed find the right business insurance for their small business.

We help thousands of different business types quickly find customized insurance packages with no extra fees. Coverage typically includes general liability insurance, professional liability (E&O), commercial auto insurance and workers’ compensation, depending on your operations.

Start an instant quote today to review options and purchase business insurance in about 10 minutes. Our team of licensed U.S.-based is standing by to help if you have any questions.