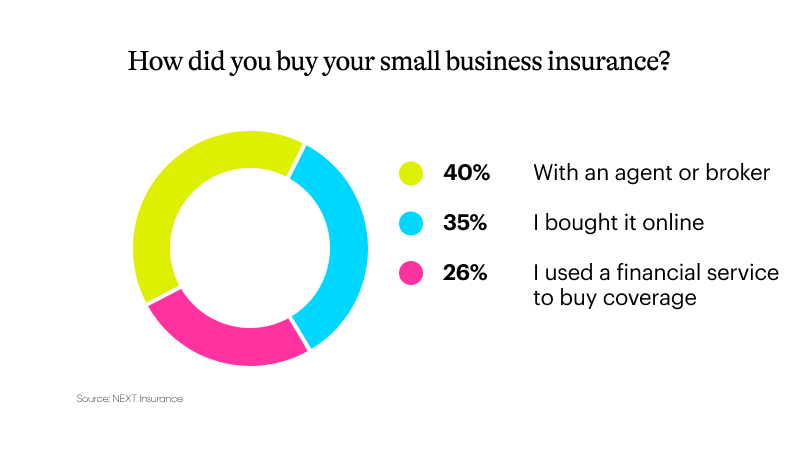

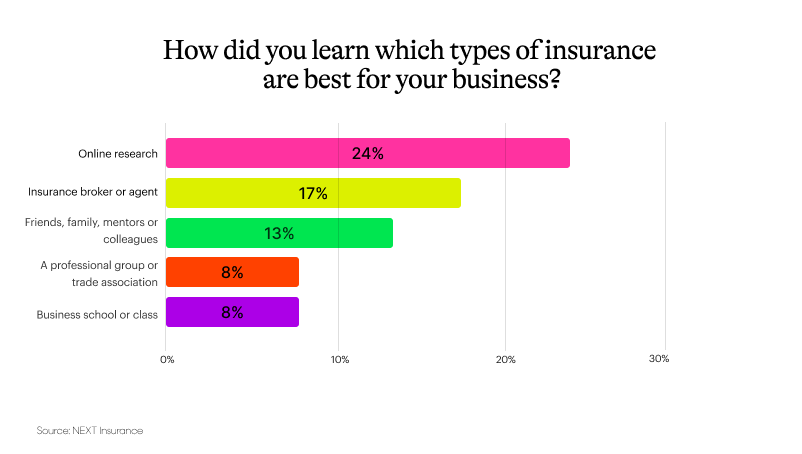

Speed and convenience are driving small business owners to go digital with their business operations, including small business insurance. A recent NEXT survey shows that they’re increasingly turning to digital platforms that let them research, compare and buy coverage without an agent and 100% online.

NEXT surveyed 1,500 small business owners in January 2025 to better understand this shift in how they buy insurance. Here’s what we found.

Jump ahead to dive into the numbers:

- Less than half of business owners buy insurance with agents or brokers

- One in four business owners research business insurance online

- Top 3 reasons people insure their business

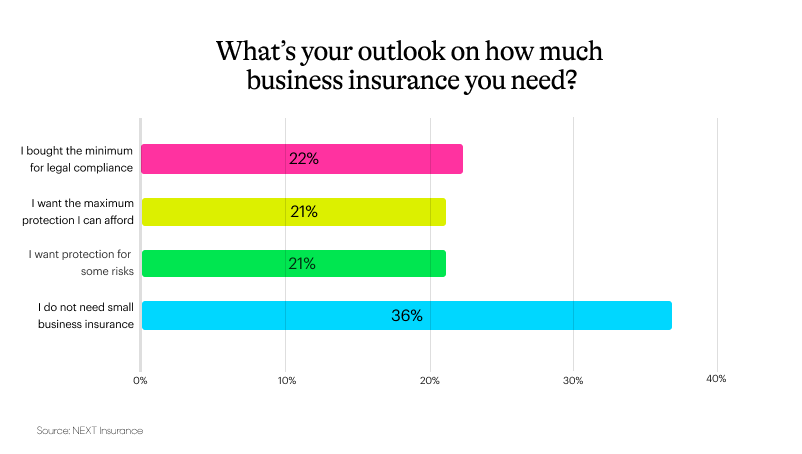

- The business insurance knowledge gap — and coverage gap — persists

- 5 tips to make the most of small business insurance

- How NEXT can help protect your small business