When you have your own construction business, managing cash flow is crucial to the success and sustainability of your business. Construction projects often involve significant upfront costs and payment delays, making effective cash flow management even more important.

7 effective construction cash flow tips for business owners

Here are seven tips to help you effectively manage construction cash flow in your business:

1. Create a cash flow forecast

A cash flow forecast is particularly important for construction businesses due to the nature of project-based work. To create a basic forecast:

- Estimate your income and expenses on a project-by-project basis.

- Consider the duration of each project. Include the time it takes to complete each phase, and the associated costs.

By having a project-specific cash flow forecast, you can better anticipate and plan for cash flow fluctuations throughout the project lifecycle.

2. Monitor and control project costs

Construction projects involve various costs, such as labor, materials, equipment and subcontractors. To maintain a healthy cash flow, closely monitor and control your project’s costs.

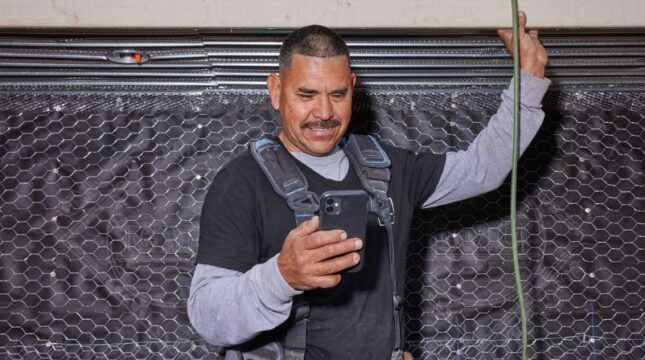

Implement robust cost tracking systems to ensure accurate and up-to-date information on expenses. Expense trackers such as Expensify, Quickbooks and Freshbooks can help track expenses as they happen and have mobile versions for when you’re on the go.

Also, regularly review project budgets and compare them to actual costs to identify any discrepancies. By effectively managing project costs, you can prevent cost overruns and maintain a positive cash flow.

3. Invoice progressively

In the construction industry, it’s common to invoice clients based on project milestones or completed stages. Instead of waiting until the project’s completion to invoice, consider invoicing progressively.

This approach allows you to receive partial payments throughout the project, improving your construction cash flow. Clearly communicate the payment schedule and milestones to clients to ensure transparency and avoid payment delays or worse — refuses to pay.

4. Negotiate payment terms with clients and suppliers

Negotiating favorable payment terms is crucial for cash flow management in the construction industry.

When entering into contracts with clients, consider requesting a deposit upfront to cover initial costs. Structure progress payments based on project milestones or completed stages. This way, you can maintain a positive cash flow as the project progresses.

Additionally, negotiate extended payment terms with suppliers to align with your cash inflows. Building strong relationships with clients and suppliers can facilitate these negotiations.

5. Manage retainage efficiently

Retainage, also known as retention, is a common practice in the construction industry. It’s when a portion of the payment is withheld until the project’s completion.

While retainage can protect clients, it can create cash flow challenges for contractors. Effective management of retainage can help improve your cash flow during and after projects.

Understand the retainage terms in your contracts and plan accordingly. Consider negotiating lower retainage rates or requesting partial release of retainage as project milestones are met.

6. Optimize inventory and material management

Construction businesses often make significant investments in inventory and materials. Inefficient inventory management can tie up valuable cash flow.

Regularly review your inventory levels and adjust your procurement strategy accordingly. Avoid overstocking materials that may sit idle, tying up cash. By optimizing your inventory and material management, you can reduce carrying costs and improve your cash flow.

7. Leverage construction-specific financial tools

Managing construction cash flow can be complex, but there are industry-specific financial tools available to help. Consider implementing construction accounting software that integrates project management and financials.

These tools can provide real-time visibility into project costs, cash flow, and profitability. By leveraging construction-specific financial tools, you can streamline your processes and make informed decisions to enhance your cash flow management.

Effective cash flow management is essential for the success of your construction business. By implementing these construction-specific tips, you can improve your cash flow, ensure timely payments, and maintain a healthy financial position. Remember, regular review and adjustment of your cash flow management strategies are essential to adapt to changing project requirements and market conditions.

How NEXT supports the construction business owners

NEXT makes it easy to explore construction insurance, purchase coverage and get a certificate of insurance within minutes so your business is protected while executing on your scope of work.

Get a quote, quickly get the coverage you need, and manage your policy via web or app 24/7.

Start a free instant quote with NEXT today.

Note: The information provided in this blog post is for informational purposes only. Please consult with a financial professional for personalized advice specific to your construction business.