What to do if a client refuses to pay you

In most lines of business, having a client refuse payment happens sooner or later. Here’s how you can take steps without acting rashly.

TIP: Remember to document all your contact attempts and interactions with the client. It’ll help you remember what was said and helps you build a good faith paper trail if you need to take legal action.

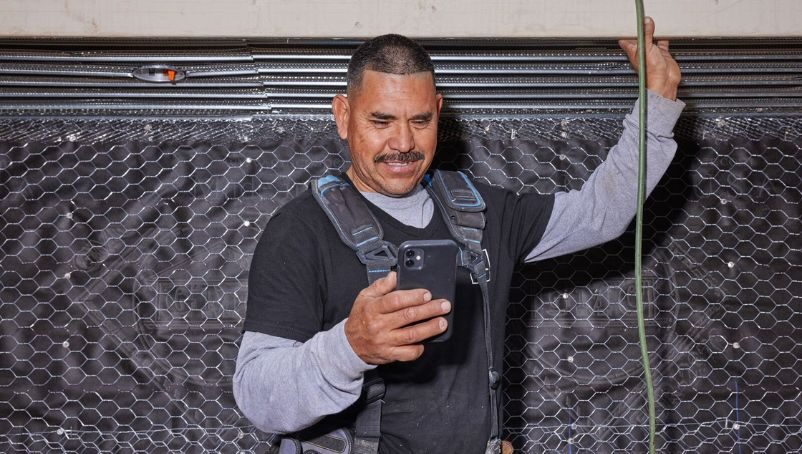

1. Communicate with the client

Clients often refuse to pay contractors because they’re unhappy with the results, so it’s important to understand why.

The first thing you should do is listen. A face-to-face conversation is the best way to go because you’ll communicate better this way than over phone, email or text. Calmly ask your client to explain exactly why they’re dissatisfied. Don’t argue, and don’t justify yourself while they’re speaking; just listen.

Once you’ve listened, start by repeating back what the client has said in your own words:

- “I understand that you feel my work did not live up to your expectations.”

- “You felt I should have been more careful about covering your furniture before I began painting.”

- “You believe the materials I used weren’t good quality.”

This is a very effective way to let them know you’re hearing them. Repeating back also ensures you understand their frustrations correctly. Giving them a chance to vent their frustration goes a long way toward rebuilding trust.

Hopefully, this will smooth the way to the next step.

2. Try to find a reasonable solution

When a client refuses to pay a contractor, there’s a good chance they don’t want to have to go through the trouble of hiring someone else. They’re withholding payment as leverage to get you to fix the problem.

Yes, redoing work may cost you in the short term. But there may be long-term consequences if you leave customers unhappy. For example, if your business receives a lot of word-of-mouth referrals, you can bet word of a bad experience will travel, too.

Think of fixing the problem as a way to invest in your business’s reputation. Most customers are happy to give you a chance to set things right, especially if you’ve established a good relationship from the beginning.

Sometimes it won’t be possible to redo the work. If that’s the case, you could offer a discount on the amount the client owes you. Discuss the possibilities with the client and see if you can come up with a deal.

But if your efforts to find a reasonable and mutually beneficial solution hit a stone wall, it may be time to take legal action.

3. Sue the client in small claims court

If you’ve exhausted all other means, you may be able to file a suit against your client in a small claims court. It’s a good idea to speak to a lawyer first to see what your options are and whether it’s worth it.

If you’re going the legal route, it’ll be very helpful to have a written contract that outlines all the details both parties agreed to. Without a written agreement, it’ll be your word versus theirs — and more difficult for a court to make a judgment.

3 tips to help you get paid for contract work

If at all possible, the best course of action is prevention. A few precautions before you start a job can help you get paid in full and on time later on.

1. Get everything in writing

For construction contractors, one of the best ways to prevent payment issues is to get all agreements between you and your client in writing. A solid contract — ideally one reviewed by a lawyer — can prevent major headaches later on.

2. Get a deposit

It’s common for contractors to ask for a percentage of the overall fee upfront as a non-refundable deposit. This way, at least you’ll receive some compensation for your time and labor if the client backs out for any reason. The deposit size depends on the work being done and the state you’re in, and can range from 10-50%.

3. Choose your clients wisely

Keep your eyes and ears open when interacting with a potential client. If something doesn’t feel right to you, consider backing out. It’s often wise to give up a job rather than work with a client you can’t trust.