E&O Product Description

- E&O coverage limits of up to $1 million per claim and $3 million policy aggregate, designed to meet most upline and insurance company requirements

- Deductible options of $0, $1,000 or $2,000 (default) are available

- Broad and tailorable definition of professional services includes expert witness testimony, teaching insurance courses, notary public, loss control or risk management consulting, benefits plan administration, and premium financing3

- Coverage is tailored to your licensed insurance activities. Life & health agents receive coverage for Medicare, health insurance, life insurance, and fixed & indexed annuities products. You may optionally select coverage for financial products including variable life and variable annuity products or mutual funds, as well as personal or commercial products if you carry the appropriate securities and P&C licenses.

- The definition of insured includes full- and part-time employees, interns, volunteers and contractors while acting on your behalf and conducting activities covered by the policy

- Coverage is provided on a claims-made and reported basis. Your policy will only cover claims first made against you and reported to us during the policy period. Prior acts coverage (retroactive date) is available upon request. Any knowledge of claims or potential claims must be disclosed in your application.

- Defense costs reduce your limits of liability and are subject to the selected deductible4

- Personal and advertising injury coverage is offered at full policy limits

- An optional 36 month extended reporting period (ERP) and free non-practicing and death/disability ERPs are available5

- An active life and/or health insurance license is required to be eligible for this program.

- Your E&O policy may be eligible for automatic renewal.6

- NEXT is 100% dedicated to small businesses, with policies designed for their needs, including:

- Instant quote/bind with no loss-run submissions

- Monthly payments with no installment fees

- No risk purchasing group or enrollment fees

- No cancellation fees, short pay or minimum earned premium

- Bundle two or more of our policies and save up to 10%.7

Disclaimers

1 To the extent permitted by law, applicants are individually underwritten, and not all applicants will qualify. Individual rates vary.

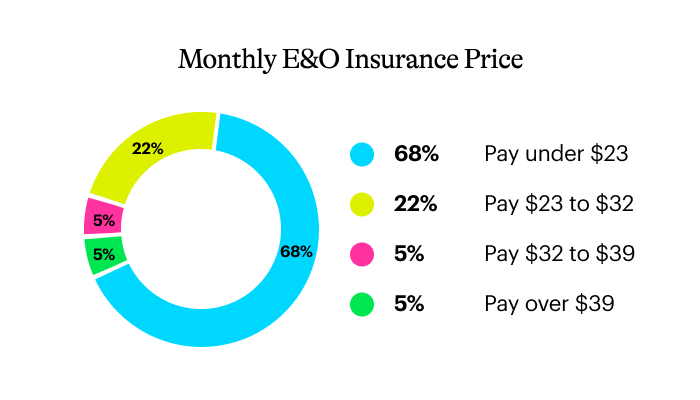

2 The pricing data presented here are based on NEXT active customers data obtained over the previous 12 months. The price range is based on cost data of equal to or over 51% of representative NEXT customers who purchased an E&O insurance policy. This data should not be considered a substitute for obtaining a quote specific to your business.

3 Policy documents govern. Only the relevant insurance policy can provide the actual terms, coverages, amounts, conditions and exclusions.

4 Defense costs are in addition to the limits of liability in AK, AR, CT, NJ, NV, NY and VT.

5 An unlimited extended reporting period (ERP) is available for CT and WY insureds; there are eligibility conditions for extended reporting periods, including 7 years’ tenure for non-practicing ERPs.

6 Subject to claims experience and any changes in product availability or underwriting, which are subject to change without notice.

7 Discounts and savings are available where state laws and regulations allow, and may vary by state. Certain discounts apply to specific coverages only.