What is Cyber Liability insurance?

What can Cyber Liability Insurance cover?

- Data breach costs

- Ransomware and cyber extortion expenses

- Business interruption if you’re forced to close

- Legal defense costs and settlements

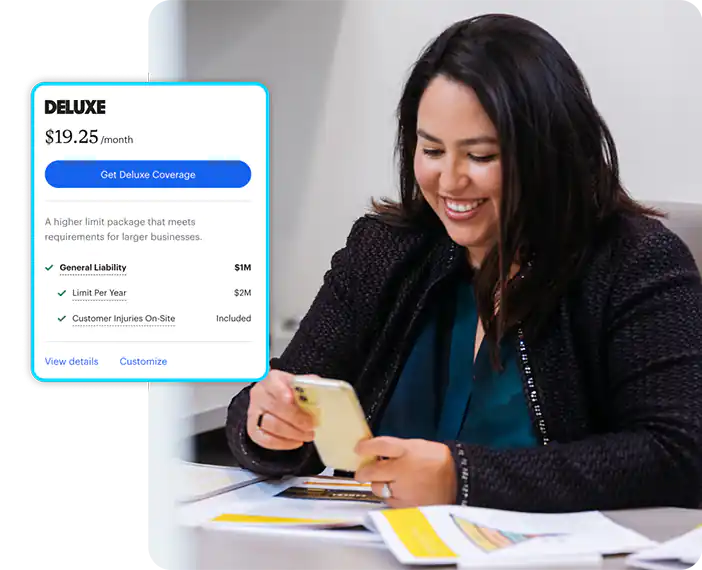

How much is Cyber Liability insurance?

Starting at $4/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs Cyber Liability insurance coverage most?

- Businesses that take credit card payments

- Anyone who stores sensitive client data

- Businesses who use POS systems

- Any business that uses digital tools or cloud software

Cyber Liability insurance can help cover business risks

Data breach

If personal or customer data is stolen or leaked.**

Ransomware (cyber extortion)

A hacker locks your system or demands payment.

Business interruption

A cyber attack or system failure shuts your business down.

Brand and reputation support

Bad publicity can directly result from a covered incident.

Legal and regulatory protection

You need an attorney to defend your business if a customer or regulator takes action after a security breach.

How much does Cyber Liability insurance cost?

ERGO NEXT cyber liability insurance starts at $4 a month† when added to your general liability policy or $15 a month when added to your professional liability insurance.

Several factors influence the price you’ll pay for insurance, including:

- Your industry

- Your business operations

- The size of your business

- Your revenue

- Where you do business

- The level of coverage you choose

- The sensitivity of your data

- Your cybersecurity best practices

- Policy limits

How do I get Cyber Liability coverage?

Tell us about your business

In about 10 minutes you’ll see your exact price for general liability or professional liability with added cyber liability coverage.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately after payment. And your certificate of insurance is ready at no extra cost.

Who needs Cyber Liability insurance coverage?

Offices and professional services

Your services run on information and reputation. If a cybercrime exposes confidential client data like financial information and contacts, cyber coverage can help with response, legal costs and reputational harm.

Retail and e-commerce

Even a small payment system breach could cost thousands in fines and lost sales to your retail shop or online store. Cyber insurance could help protect you from the costs of cybercrimes like payment card data theft, POS malware and online hacks.

Restaurants and food service

A single tech outage or data theft can halt payment processing and bring business to a standstill at your restaurant, bakery or other food and beverage business. Cyber insurance can help you recover quickly and get back to work.

Cyber Liability insurance FAQ (frequently asked questions)

Is Cyber Liability insurance required by law?

Cyber liability insurance may be required in your state. Regulatory frameworks like the California Consumer Privacy Act (CCPA) require organizations to have high standards of data privacy.

In addition, some professional organizations could require coverage before issuing you a work license or permit. And some clients may ask for proof of cyber liability or other business insurance before they’ll work with you.

What can Cyber Liability insurance cover?

1. Cyber liability insurance can help cover the costs of a data breach response. If a hacker gains access to your network and customer data is stolen or leaked, insurance could help pay for:

- IT and legal investigations

- Customer notification

- Credit monitoring or identity protection services

2. Cyber extortion/ransomware attacks. Data held hostage by bad actors demanding payment can mean interruption of your company’s computer systems, permanent loss of data or reputational damage to your brand.

If a security failure disrupts your business, you may qualify for lost income and expenses under your insurance policy.

If a hacker locks your systems or demands payment, ERGO NEXT could help with:

- Ransom payments (covered only with prior written consent and law-enforcement notification)

- Negotiation and investigation costs

3. Business interruption income. Cyber coverage could help replace lost income and pay extra expenses to keep your business running if a cyber attack or system failure shuts you down.

4. Legal defense costs, including settlements and some regulatory penalties.

5. Brand and reputation support. Coverage can help pay for reputation support if bad publicity directly results from a covered data breach or cyber incident (with our consent).

What’s excluded from Cyber Liability insurance?

ERGO NEXT cyber insurance does not cover physical property damage, bodily injury or intentional criminal acts. It also does not cover known events or system failures that occurred before the policy period began.

Specific exclusions include:

- Intentional or criminal acts by you or your employees

- Bodily injury or property damage (but these could be covered under your general liability policy)

- Known incidents before the policy start date

- War or state-sponsored cyber operations

- Failure to maintain required security standards (for example, PCI DSS noncompliance)

- Dependent system failures (such as a vendor’s cloud outage)

- Patent infringement or trade secret theft

- Mass global outages or “widespread events” affecting many businesses simultaneously

How much Cyber Liability insurance coverage do I need?

The coverage you need depends on a number of factors, including:

- The type of work you do

- How many employees you have

- Your level of risk

- The state where you work

If you rely on technology and email communications, you could be at risk of a wide range of cyber threats.

How does Cyber Liability insurance work?

Cyber liability insurance can also be called cyber insurance, cybersecurity insurance or cyber risk insurance.

At ERGO NEXT, you can add cyber liability insurance to your general liability insurance or your professional liability insurance policy. (Note that professional liability coverage can also be called errors and omissions insurance, or E&O, depending on your profession.)

Will Cyber Liability insurance cover ransom payments if I get hacked?

Cyber liability insurance could help cover the cost to restore your data if a hacker encrypts your business data and won’t unlock it until you pay a ransom.

A ransomware attack can mean a total interruption of your company’s computer system, permanent loss of data or reputational damage to your brand.

If a security failure such as a Denial of Service attack (DoS) disrupts your business, you may qualify for lost income and expenses under your insurance policy.

Can Cyber insurance cover data breach claims?

Yes, this type of coverage can cover the costs of a data breach or phishing incident if a hacker gains access to an employee’s email or creeps into your network.

This could include expenses such as:

- Legal fees

- Forensics and PR costs following a breach

- Researching and notifying customers

- Credit monitoring

- Regulatory penalties resulting from the breach

- Other miscellaneous incident response tasks

Why choose ERGO NEXT for Cyber Liability coverage?

We specialize in small business insurance. ERGO NEXT focuses on the most common digital risks for your business.

Financial protection. Coverage can help cover costs to recover and defend your business from many cyber incidents.

Flexible coverage. You choose the right level of protection for your business with limits up to $250,000.

Instant coverage. Get a quote, buy your policy and get proof of insurance immediately.

Quick claim response. File a claim and your dedicated claims advocate will help you resolve it ASAP.

100% online. Manage all your policies via web or mobile app 24/7.

How do I make a Cyber Liability insurance claim?

You can file a claim anytime online or in the ERGO NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

Is Cyber Liability insurance tax deductible?

Your general liability or professional liability insurance with a cyber liability insurance add-on can typically be deducted from your business taxes. It’s important to consult with a licensed accounting professional to make sure you qualify.

The IRS categorizes payments you make for this type of insurance to be an “ordinary and necessary” business expense. Be sure to keep a file of how much you pay every year for your policy.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your sharable certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the ERGO NEXT app for iPhone or Android.

ERGO NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought ERGO NEXT was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.